What is Customer Lifetime Value (LTV)?

Customer Lifetime Value (LTV) is a common metric in the digital industry that estimates the total profit a business can expect from a single customer account throughout their relationship.

It goes beyond just revenue to account for the costs associated with servicing that customer, providing a fuller picture of the value a business extracts from a customer relationship. In fact, an essential element to factor in when calculating LTV is the Gross Margin: Gross Margin represents the percentage of revenue left after subtracting the costs associated with delivering your product or service.

How to calculate the LTV of a customer

In essence, the LTV is calculated by multiplying the average revenue per customer by the expected duration of the customer relationship and then adjusting for profitability using the Gross Margin.

More in details, you need to implement the following steps:

Calculate the Annual Revenue Per Account (ARPA):** ARPA = Total Annual Recurring Revenue (ARR) / Total number of accounts

Determine the Annual Churn Rate:** This is typically expressed as a percentage of customers who leave within a year.

Compute the Expected Customer Lifetime (in years):** Expected Lifetime = 1 / Annual Churn Rate

Calculate the Customer Lifetime Revenue (LTR):** LTR = Expected Lifetime * ARPA

Determine the Gross Margin percentage:** This is the percentage of revenue that remains after accounting for the cost of goods sold.

Finally, calculate the Customer Lifetime Value (LTV):** LTV = Customer Lifetime Revenue * Gross Margin

Example: Let's say a company has:

Total ARR: $1,000,000

Total accounts: 100

Annual Churn Rate: 10%

Gross Margin: 70%

As a result:

ARPA = $1,000,000 / 100 = $10,000

Expected Lifetime = 1 / 0.10 = 10 years

LTR = 10 * $10,000 = $100,000

LTV = $100,000 * 0.70 = $70,000

Therefore, the Customer Lifetime Value in this example is $70,000.

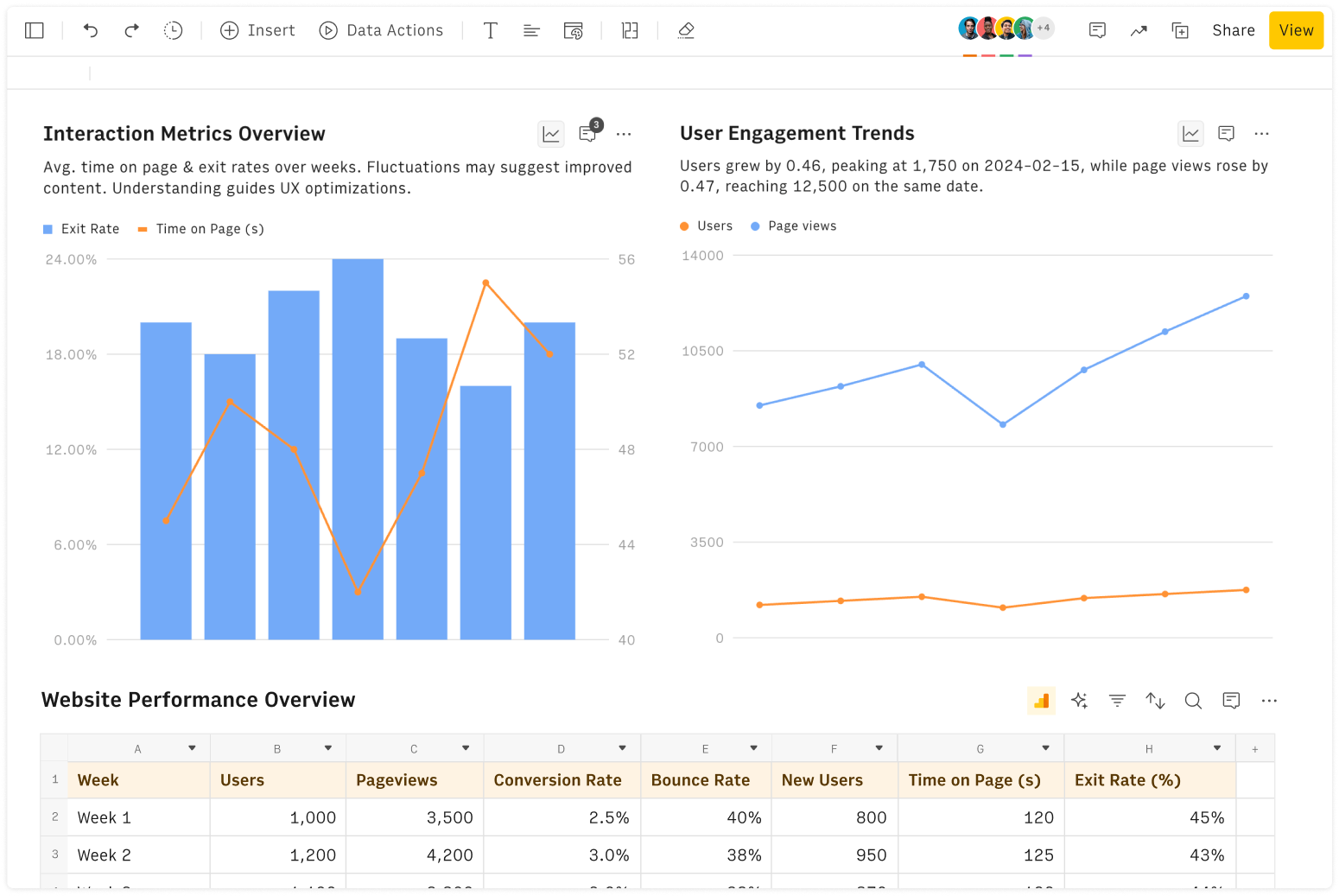

How to use this Customer Lifetime Value calculator

This calculator offers a quick way to estimate the LTV of a customer.

All you need to do is to enter the following variables:

Total ARR (Annual Recurring Revenue)

Total number of accounts

(Average) Annual Churn rate

Gross margin percentage (1 - COGS / ARR)

The calculator will then automatically return the following results:

ARPA (Annual Revenue Per Account)

Expected customer lifetime (in years)

LTR (Customer Lifetime Revenue)

LTV (Customer Lifetime Value)

Why LTV matters for your business

Understanding and optimizing your customer lifetime value is crucial for sustainable business growth.

Here are some key reasons why LTV should be a central metric in your business strategy:

Informed marketing decisions: By knowing your LTV, you can determine how much you can afford to spend on acquiring new customers while maintaining profitability.

LTV to CAC Ratio:

A typical benchmark is to aim for an LTV to CAC ratio of 3:1. This means that the revenue generated from a customer over their lifetime should ideally be three times the cost of acquiring that customer. A lower ratio might indicate that you are spending too much on customer acquisition relative to the value you're generating, while a higher ratio could suggest opportunities to invest more in growth. Discover more using our LTV to CAC calculator and CAC calculator.

Customer segmentation: LTV helps identify your most valuable customer segments, allowing you to tailor your marketing and retention efforts accordingly.

Retention focus: A high LTV highlights the value of investing in customer retention strategies, which are often more cost-effective than acquiring new customers.

Product development: Understanding which products or services contribute most to LTV can guide your product development and improvement efforts.

Forecasting and planning: LTV provides valuable insights for revenue forecasting and long-term business planning.

FAQ

What's the difference between CLV and LTV?

Customer Lifetime Value (CLV) and Lifetime Value (LTV) are often used interchangeably, but there can be subtle differences: - CLV typically focuses on the value of an individual customer. - LTV may sometimes refer to the average value across all customers.

For most practical purposes, these terms mean the same thing. Our calculator can be used for both CLV and LTV calculations.

Can LTV be negative?

Yes, LTV can be negative, though it's a sign of an unhealthy business model. This situation occurs when the acquisition costs and ongoing expenses to maintain a customer exceed the revenue generated from that customer. A negative LTV indicates that a company is losing money on its customer relationships, which might suggest the need for adjustments in pricing, customer acquisition strategies, or operational efficiency.

How often should I recalculate LTV?

It's important to recalculate LTV periodically to ensure that it reflects current business conditions. As customer behavior, pricing strategies, and business models evolve, so does the accuracy of your LTV. Recalculating LTV quarterly or bi-annually is often recommended, especially in fast-changing industries or during periods of significant business changes.

How to calculate LTV for 5 years?

To calculate a 5-year LTV for a specific customer, you need to: 1. Determine its yearly expected revenue (ARPA). 2. Multiply it by Gross Margin to account for the costs generated by acquisition and ongoing maintenance of the client. 3. Apply a discount rate to account for the potential churn. 4. Sum the discounted values for the 5-year period.