The Post-money calculator helps you calculate the post-money valuation of a company knowing the last investment round and its pre-money valuation.

Pre-money valuation is commonly known as the value of a company before receiving new funding, while post-money valuation is the value after receiving the new investment.

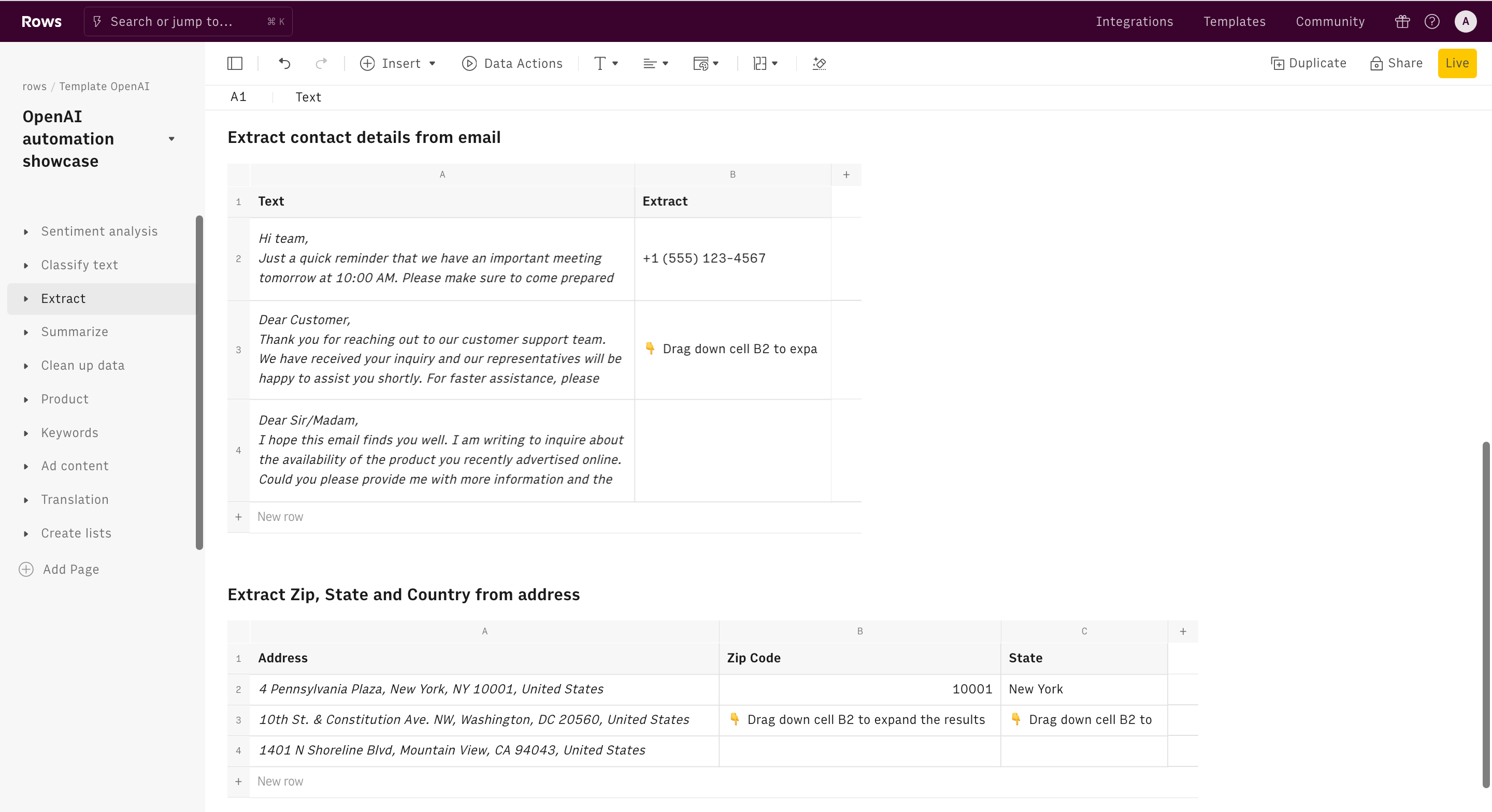

How to use the Post-money Valuation Calculator

To obtain the post-money valuation of your round, input the following data points:

Investment amount, that is the amount of money raised in the round

Pre-money valuation, the assessment made by the investor on the company worth before receiving the new money

The output includes:

Post-money valuation = Pre-money valuation + Investment amount

Investor share (%) = Investment amount / Post-money valuation

Practical Example of Post-Money Valuation

A startup raises $1m investment round at a $4m pre-money valuation. This leads to:

Post-money valuation = $4m + $1m = $5m

Investor share (%) = $1m / $5m = 20%

Startups and external funding

Startups often seek external funding to fuel their growth and achieve their business objectives. Securing investment can provide crucial capital, resources, and expertise, enabling startups to scale their operations, develop innovative products or services, penetrate new markets, and ultimately increase their chances of long-term success.

Besides the valuation, which ultimately determines how diluted founders will get, a few other relevant aspects must be taken into account when considering opening your company cap table to new shareholders:

Type of shares: The class of shares being issued, such as common shares or preferred shares, as they can have different rights, privileges, and voting power.

Liquidation preference: The order in which investors get paid in case of a liquidation event, ensuring they receive their investment amount before other shareholders.

Anti-dilution provisions: Mechanisms that protect investors from dilution in the event of future equity issuances at a lower valuation, potentially adjusting their ownership percentage.

Voting rights: The extent of decision-making power held by different classes of shares, which can impact the founders' control over the company.

Board representation: The allocation of seats on the company's board of directors, allowing investors to have a say in strategic decisions.

Founder vesting: The schedule and conditions under which founders' shares fully "vest," meaning they are entitled to their ownership percentage, often used to incentivize founders to stay with the company.

Rights of first refusal and co-sale: Provisions that govern the sale of shares, giving existing shareholders the opportunity to purchase shares before they are sold to outsiders.

Exit provisions: Terms related to the company's potential sale or initial public offering (IPO), including the conditions and distribution of proceeds among shareholders.

Investor reputation: Considering the track record, expertise, and strategic value that potential investors bring to the table, beyond financial investment.

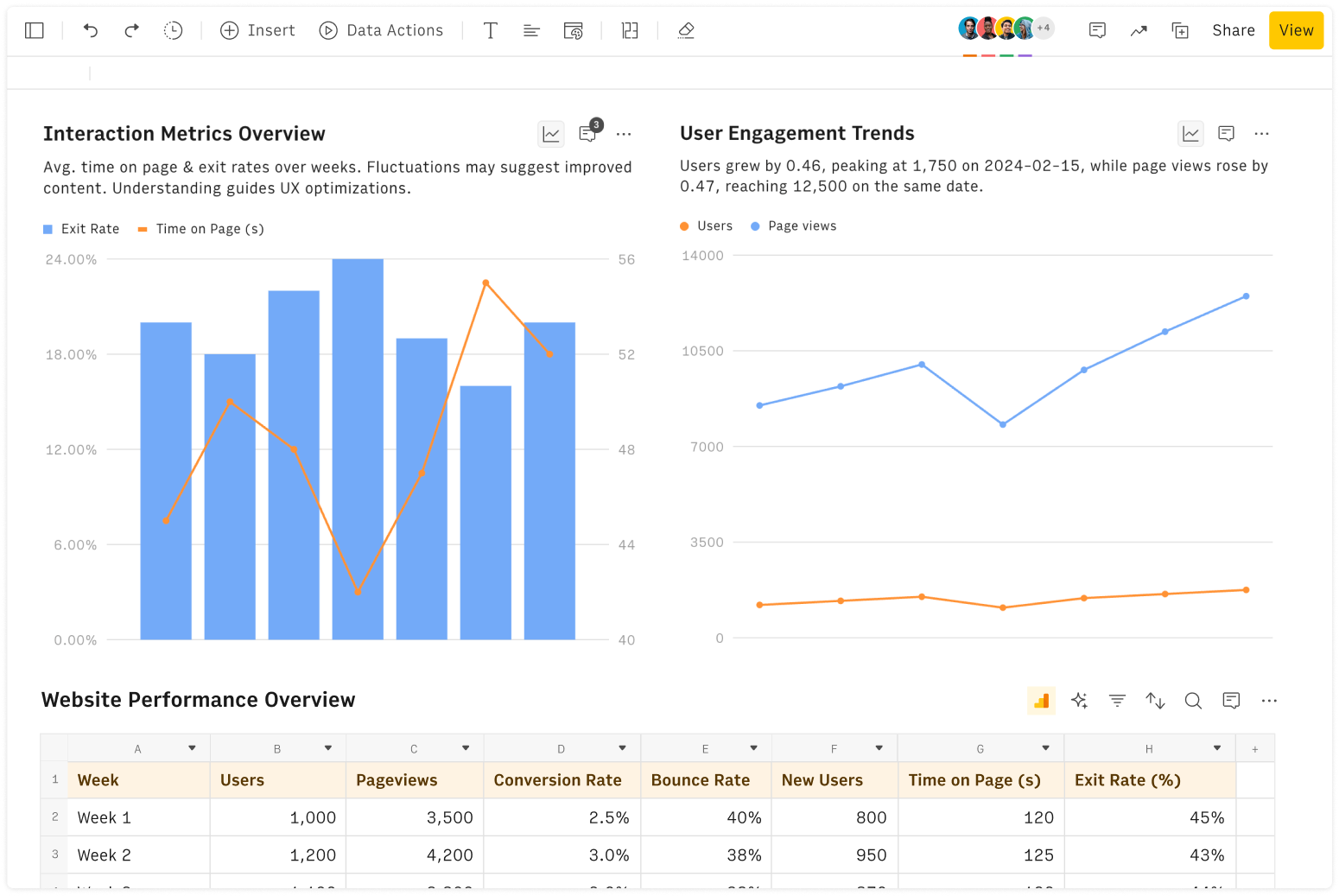

Looking for a more detailed use case? Try out our Investment round calculator to quickly calculate the impact of your next funding round on your current cap table.