What is Rows

What is fund raising about

Any founder knows that convincing investors to part with their money is no small feat, and it can be very difficult for a startup to stand out in a crowded market and prove its potential for success. Creating a compelling pitch, optimizing it after feedback, and coping with tricky questions or objections are steps of a learning curve that needs to be steep and fast.

That's why founders need to handle the process of raising money, often very time-consuming, in a methodic and structured way.

In this short guide, we'll walk you through a simple - yet effective - way to plan and track your fundraising activity.

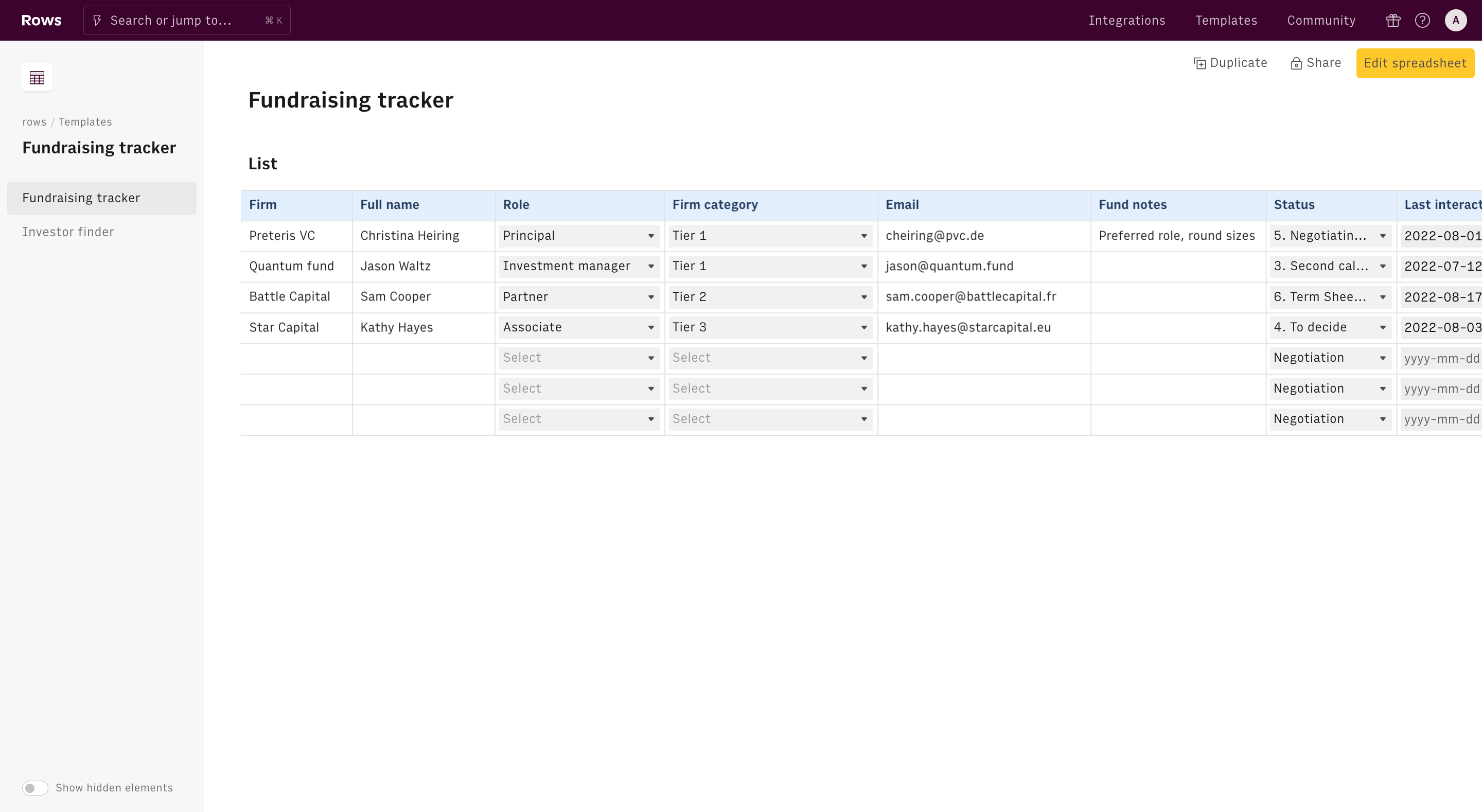

Here's a sneak peek of what you'll get:

How to track fund raising with Rows

To use our template, follow the link Fundraising tracker, click on Use template and save it in one of your workspace’s folders.

This template offers you an easy UI to plan and track your fundraising activity.

Let's reverse-engineer it together.

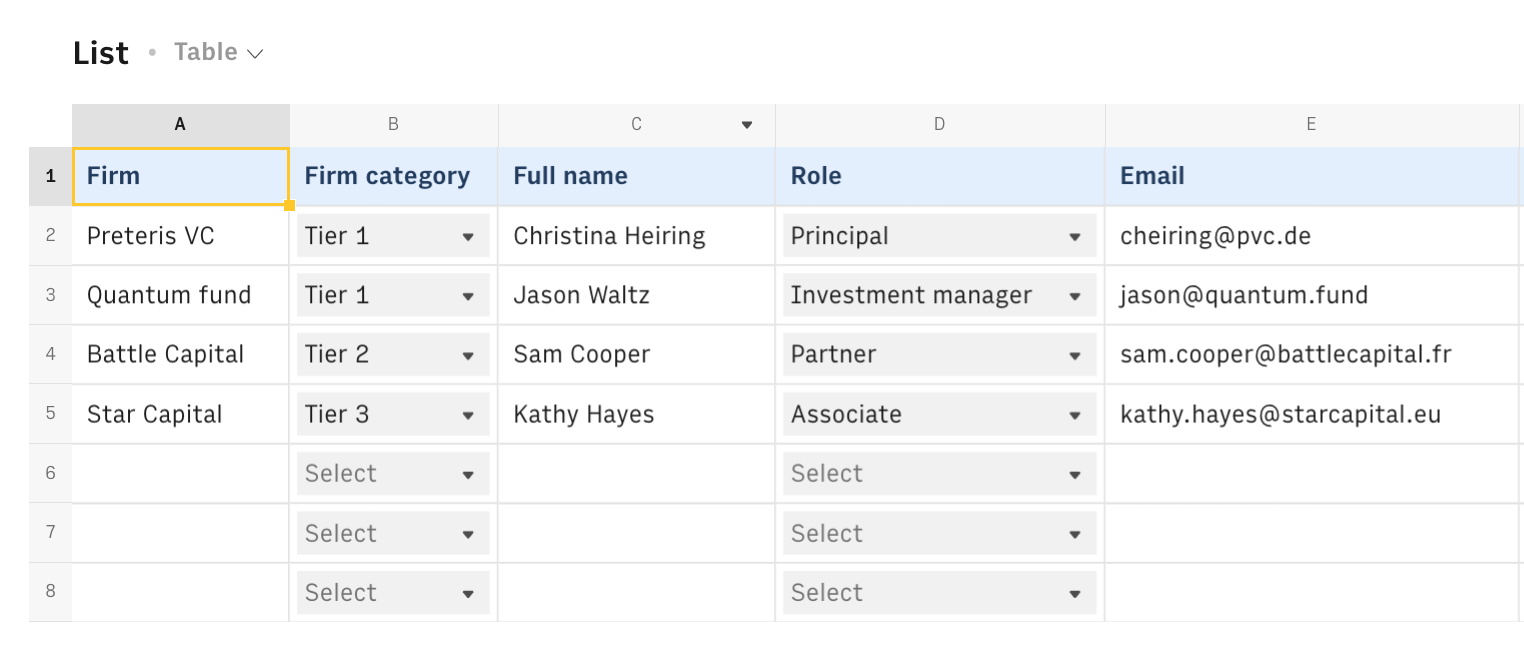

First, use columns A to E of the List table to input the details of the investors you are in contact with: start with the name of the fund, the role, full name, and email of your contact.

In column B input the firm tier, where Tier 1 refers to the top, most prominent investors. We recommend you start your fundraising activity from the lower tier, to train your pitch, optimize your deck and learn how to cope with tricky questions or objections.

Column F is meant to note down some specs or preferences of each firm, such as preferred role, round sizes, ticket sizes, and industry or regional focuses.

Columns G to J aim is to track the progress of your conversation: pick the status from the dropdown list, input the date of your last contact, and the feedback. Column J displays the number of days since your last iteration, and updates every day through the following formula in the header:

1=AUTOFILL("Days since last interaction",REPEAT(TODAY()-H2,1,"d"))The AUTOFILL() triggers the function in the second argument into all cells of the columns, when new input data are available. The formula REPEAT(TODAY()-H2,1,"d") triggers the difference between TODAY() and the last iteration date in H2 daily.

Finally, as this decision happens very late in the fundraising process, input the target investment amount in column K and leave column L for further notes.

Embed the fund raising tracker into your documents

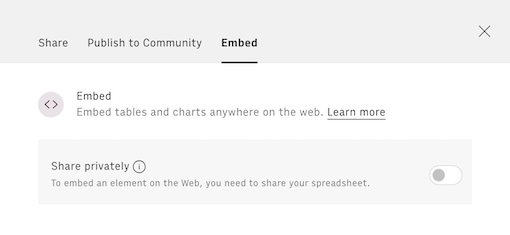

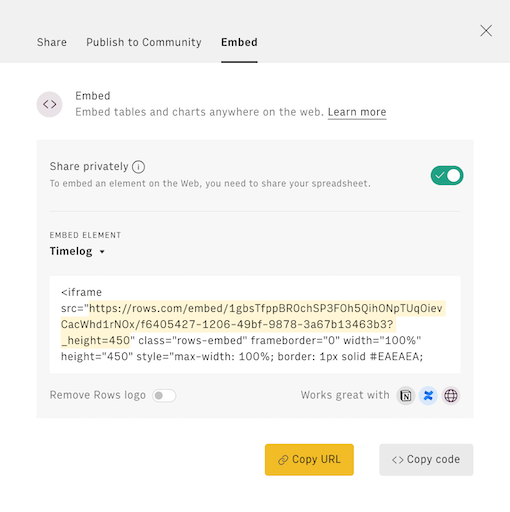

If you are using Notion or any other internal tools that support iframes to build a report, you can embed any table or chart of this spreadsheet in your document. Just click on the ... icon in the top right corner of any table or chart and pick Embed. A modal will open, as follows:

Before embedding, you need to grant access to it. To do so, toggle on the Share privately option and then hit the Copy URL button: your element is now ready to be pasted into your favorite tool.

Top reasons to keep your fund raising activity organized

By implementing a well-tracked fundraising process that makes the most of collected feedback, you can improve your investor relations, make more informed decisions, and ensure compliance and effective record-keeping – all of which can contribute to more successful and sustainable fundraising outcomes. Let's go through them:

Investor Feedback and Relations

- Tracking the fundraising process allows you to collect valuable feedback from potential investors.

- This feedback can help you improve your pitch, address investor concerns, and align your strategy with their expectations.

- Maintaining strong investor relations through feedback can lead to more successful fundraising and future partnerships.

Data-Driven Decision Making

- Detailed tracking of your fundraising activities provides you with valuable data and insights.

- You can analyze this data to identify patterns, bottlenecks, and areas for improvement in your fundraising process.

- Using data-driven insights can help you optimize your fundraising efforts, leading to faster closures, better terms, and higher success rates.

Compliance and Record-Keeping

- Thorough tracking ensures you maintain accurate and comprehensive records of all investor interactions and documentation.

- These records are crucial for compliance purposes and can help you demonstrate transparency to existing and potential investors.

- Well-organized records also streamline the process during audits, legal disputes, or future funding rounds, and enable a smooth transition for new team members.