What is Rows

What is a Cap Table

Managing investors' and shareholders' expectations starts with a clear outline of who owns what, namely your Cap Table: a simple, yet powerful, document, that displays your equity structure and investments and helps you evaluate the impact of new issuances.

In this guide, we'll walk you through everything you need to build your initial Cap table and keep it updated over time, as soon as new investors come on board.

Here’s a sneak peek of what you will get:

Useful terms related to Cap Table

Before diving deep into our Cap Table builder, let's go through some useful concepts:

- Common shares. Securities issued to shareholders carrying economic and voting rights. Usually referred also as 'Common stock'.

- Preferred shares. Special shares with additional economic rights, usually issued to external investors in the company

- Fully diluted. It refers to the total number of shares a company would theoretically have if all dilutive outstanding securities were exercised (i.e. convertible notes or stock options).

- Pre-money valuation. It refers to the value of a company not including the latest round of funding. It's usually described as how much a startup might be worth before a new investor steps in.

- Post-money valuation. It refers to the value of a company after the latest round of financing. Post-money is thus pre-money plus the round size.

- Convertible note. It's a form of debt that converts into equity, typically in correspondence with a future financing round.

- Anti-dilution. It's a clause that allows one investor to keep its percentage share of the company when specific dilutive events happen.

- Liquidation preference.It's a clause that allows one investor to be paid back a multiple (1x, 2x..) of what it invested before common stockholders, in case of liquidation events. It can be participating or non-participating, depending on whether or not it allows the investor to also participate, pro rata, in the remaining proceeds.

- Employee equity pool. A portion of a company's common shares granted to Employees. Often used to align the management's incentive to shareholders' and issued in the form of a Virtual Stock Option

- Virtual stock option. A security that gives the holder, at a specific time in the future, the right to a cash payment tied to the value of the company shares.

How to use our Cap Table template

To use our template, follow the link Cap Table, click on Use template and save it in one of your workspace’s folders.

Let's reverse-engineer it together.

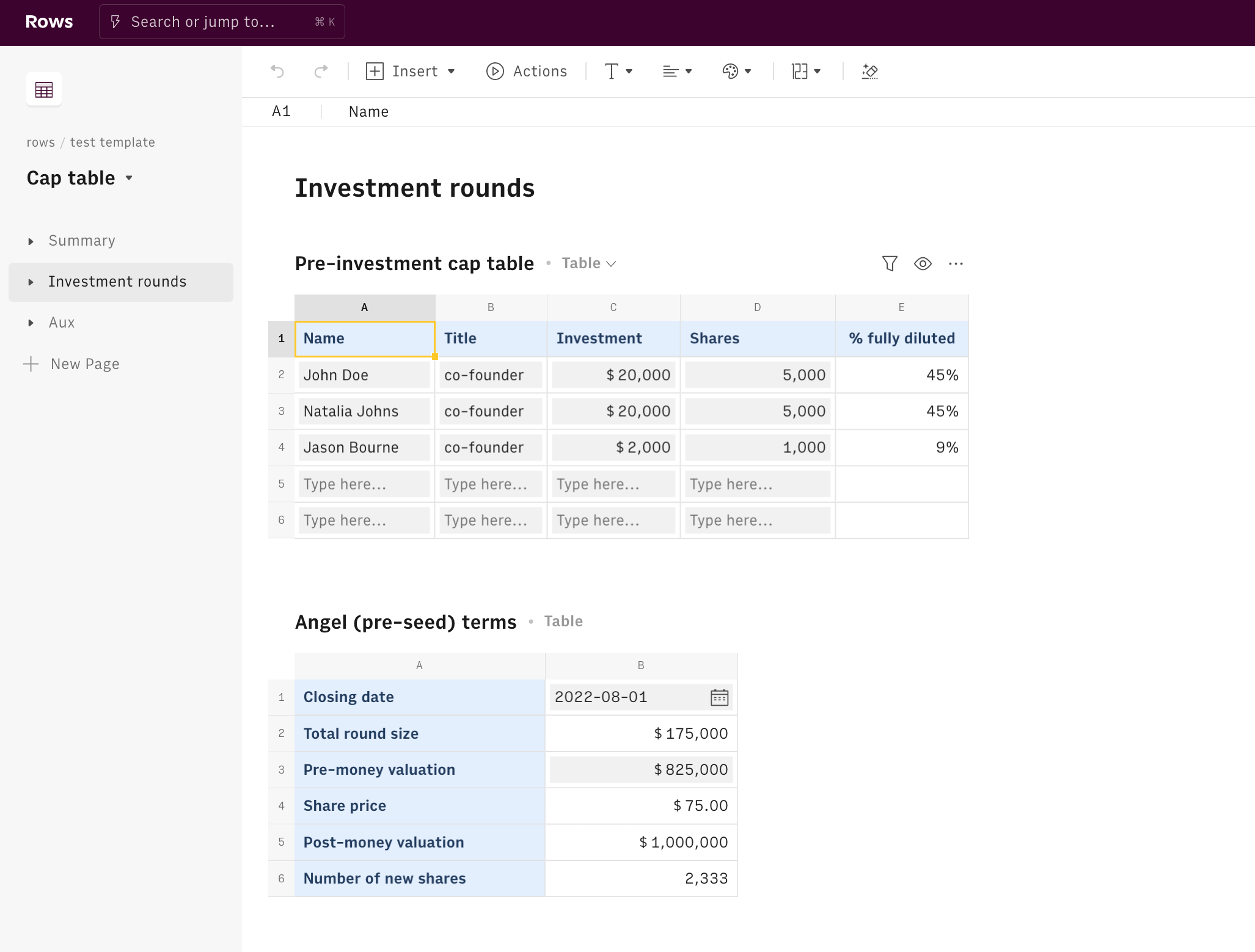

The spreadsheet has been designed to allow you to input consecutive investment rounds and keep track of the respective impact on the cap table. The structure is the following: for each stage, you fill your initial cap table, then you input the investment specs and the spreadsheet automatically computes the new cap table. The first page includes a Summary cap table that results from all the iterations in the Investment rounds page.

Let's start by looking at the Investment rounds page. Here you may find different cap tables, each one aiming at representing a specific phase of your company lifecycle.

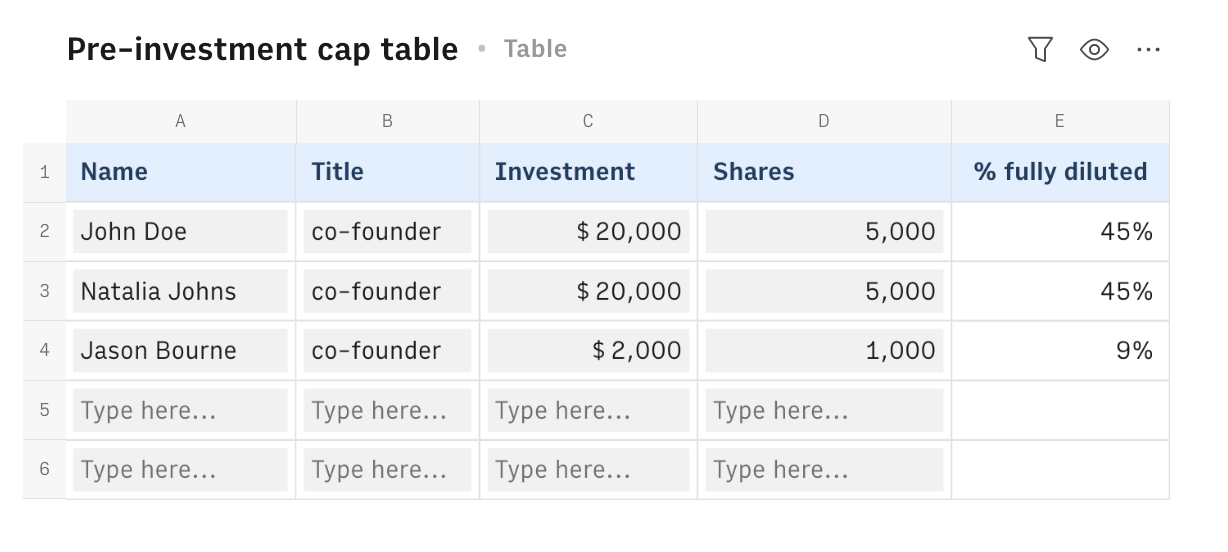

The first one is the Pre-investment cap table: before any investors come in, the equity is usually split among the company co-founders. Input their name, title, initial investment, and the number of shares allocated. Column E will automatically compute the fully-diluted % share.

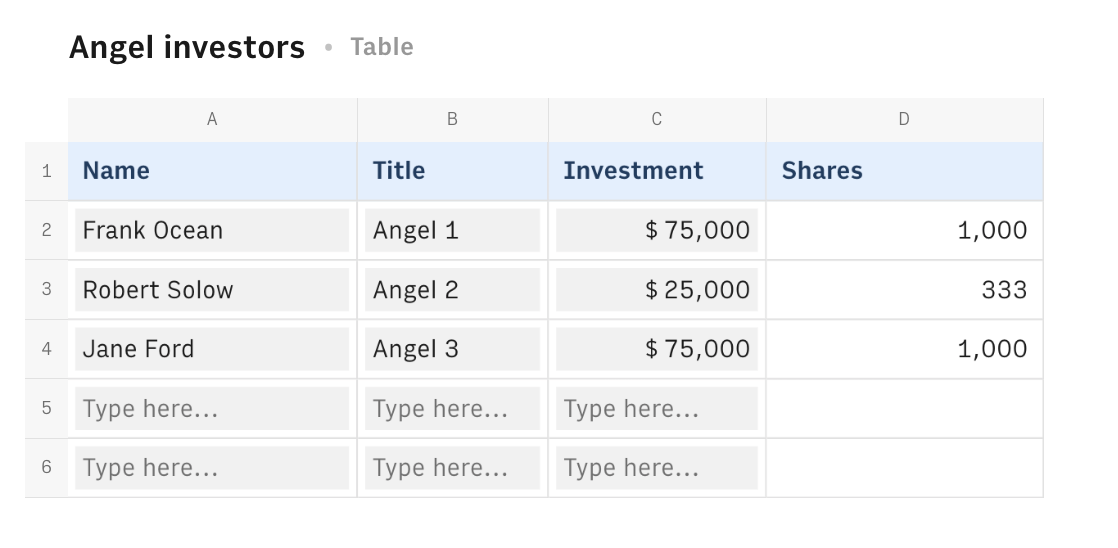

Very soon, and still, in the earliest phases of your startup, you might need some (smart) money. Usually, angel investors are the answer. Choose them wisely, based on the expertise that they can bring to you. In these cases, most likely you will have a say in setting the terms and conditions of the deal, such as the pre-money valuation. Use the Angel investors table to input their names first, along with the invested amount.

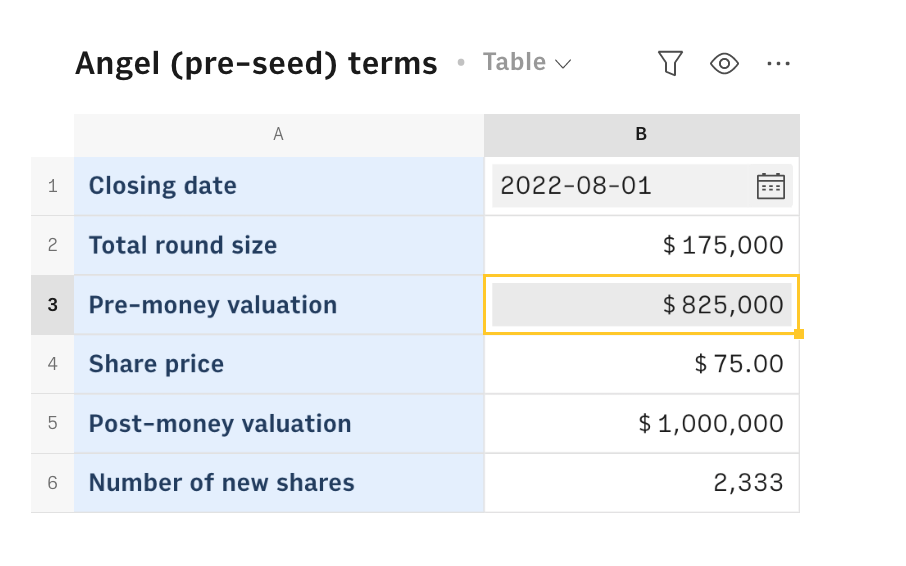

Then set your pre-money valuation in the Angel (pre-seed) terms table.

It will compute automatically the share price as the pre-money valuation divided by the number of outstanding shares (i.e. the co-founders' ones):

1=ROUND(B3/SUM('Pre-investment cap table'!D:D))As a result, the number of new shares to be issued is computed as the amount of money raised over the share price, as follows:

1=ROUND(B2/B4)When it comes to raising your first seed round, you might have thought to incentivize your employees by giving them some equity.

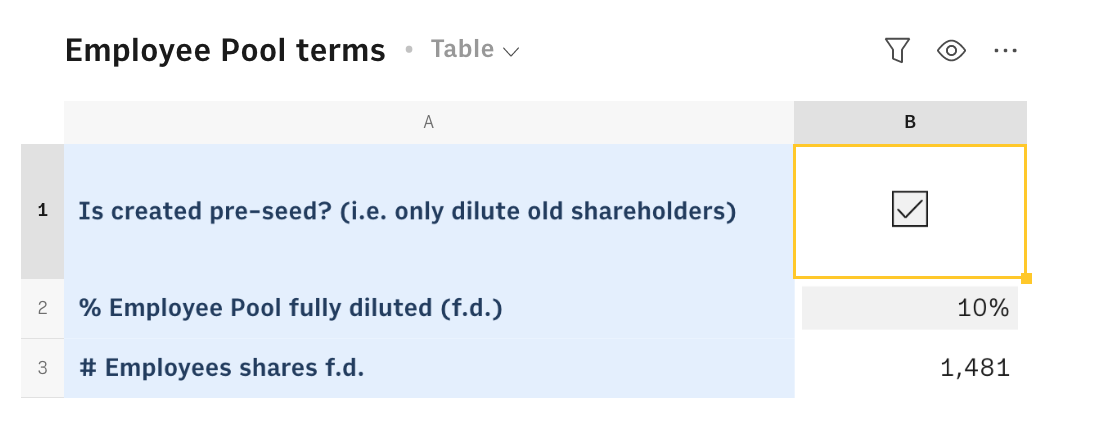

First, use the Employees pool terms table to set its conditions: choose whether it's created before or after the seed round, altering the total dilution effect, and the % of fully diluted shares you want to devote to it, usually 10-15%.

The table will automatically compute the number of shares dedicated to the round dividing the through the following formula:

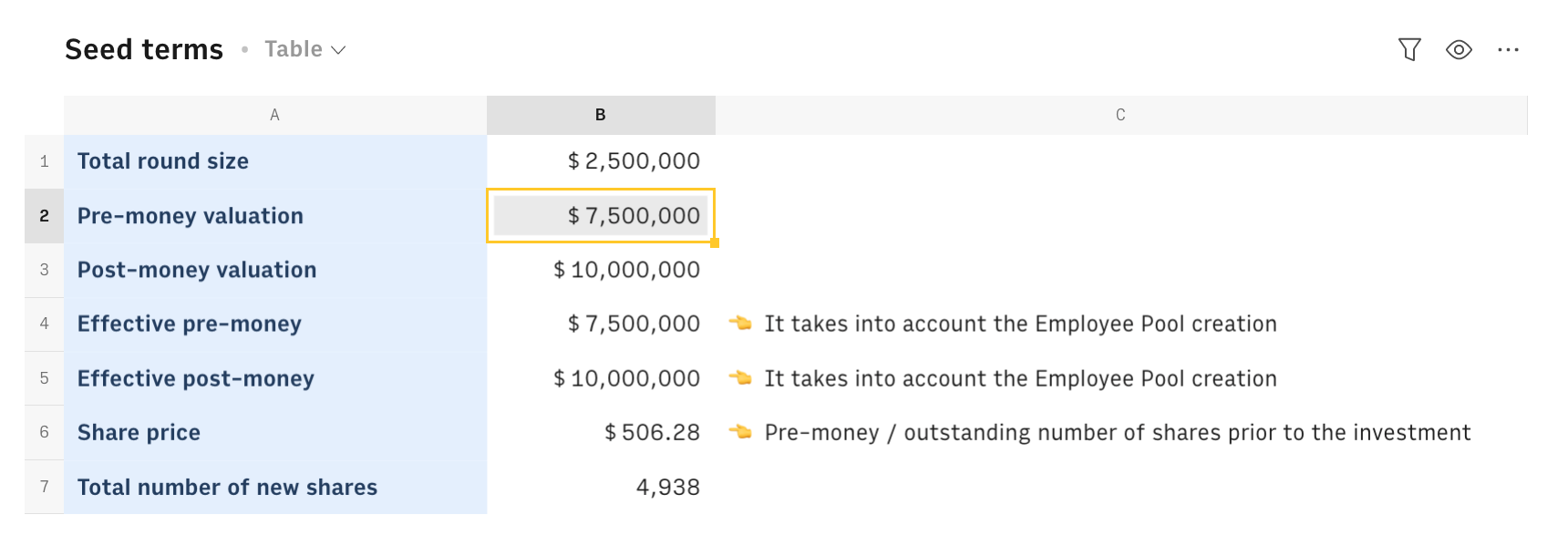

1=IF(B1="TRUE",ROUND(B2*SUM('Post-angel cap table'!D:D)/(1-B2)),ROUND(B2*(SUM('Post-angel cap table'!D:D)+'Seed terms'!B7)/(1-B2)))Then, input your Seed pre-money valuation as negotiated to your investors in the Seed terms table: the table will automatically calculate the # of shares to be issued and the share price, dividing the pre-money valuation by the number of outstanding shares before the investment (findable in the Aux page, in the Post-Angel cap table).

If the Employee Equity pool is created after (or within the seed round) then the effective pre-money valuation should account for the additional shares your company has to issue to create the Employees pool. This logic is shown in cell B4 which adds the monetary value of the Employee Pool (# shares times price) to the regular pre-money valuation of the round, as follows:

1=IF('Employee Pool terms'!B1,B2,B2+'Employee Pool terms'!B3*B6)The effective post-money valuation will just be the effective pre-money plus the total round size.

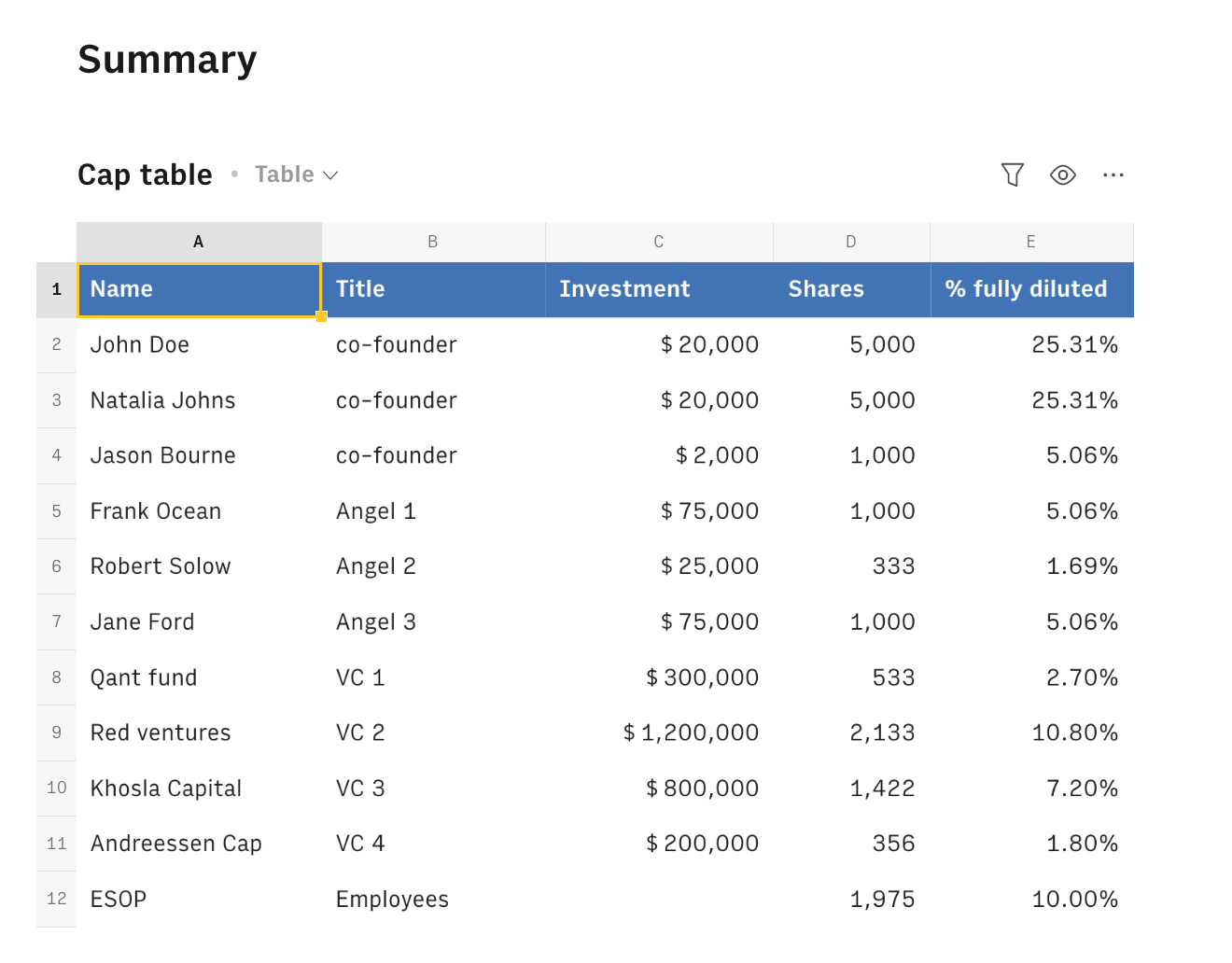

Let's now go back to the first page, that offers you a summarized view of your current equity structure, based on all investment rounds recorded.

Technically, this table merges different intermediate tables from the Investment round page and recomputes the fully diluted % share for each investor. The formula in cell A1 first transforms tables into {data} objects throughRANGE2JSON, then it usesAPPEND() to merge those JSONs together. Please notice that to fit the cap table structure (Name | Title | Shares | Share), the Employee Pool table has to be rearranged through the functionPAIR2JSON.

EXPAND() puts the cherry on top, to display the new {data} structure again in the final table.

1=EXPAND(APPEND(RANGE2JSON('Post-angel cap table'!A1:D1,'Post-angel cap table'!A2:D), RANGE2JSON('Seed investors'!A1:D1, 'Seed investors'!A2:D), PAIR2JSON("Name","ESOP","Title","Employees","Investment","","Shares",'Employee Pool terms'!B3)))To expand the template in case of further financing rounds, such as Series A and B, just duplicate the Seed Terms and Seed Investors tables and input the specs of the new investment round. Then, edit cell A1 of the Summary cap table, adding the new Investor table (e.g. Series A investors) in JSON format (through RANGETOJSON() function) as a 4th argument of the APPEND() function, as follows:

1=EXPAND(APPEND(RANGE2JSON('Post-angel cap table'!A1:D1,'Post-angel cap table'!A2:D),RANGE2JSON('Seed investors'!A1:D1,'Seed investors'!A2:D),PAIR2JSON("Name","ESOP","Title","Employees","Investment","","Shares",'Employee Pool terms'!B3),__RANGE2JSON('Series A investors'!A1:D1,'Series A investors'!A2:D)__))Feeling like a Pro? Try out this spreadsheet built by Cherry Ventures.

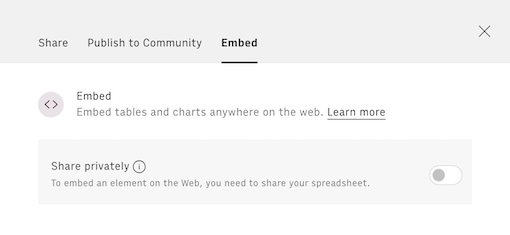

Embed your Cap Table into documents

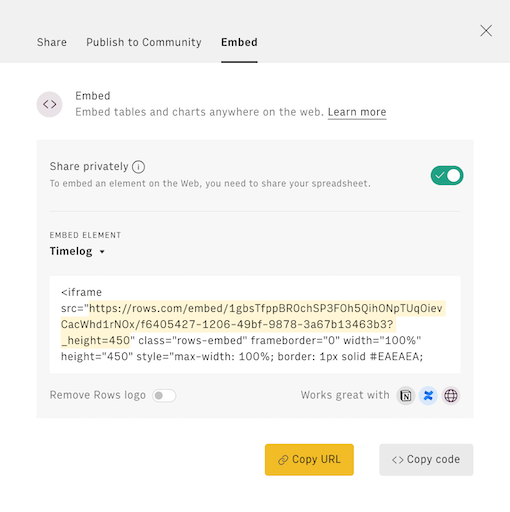

Finally, if you are using Notion or any other internal tools that support iframes to build a report, you can embed any table or chart of this spreadsheet in your document. Just click on the ... icon in the top right corner of any table or chart and pick Embed. A modal will open, as follows:

Before embedding, you need to grant access to it. To do so, toggle on the Share privately option and then hit the Copy URL button: your element is now ready to be pasted into your favorite tool.

3 benefits of a tidy Cap Table

A well-maintained cap table provides a clear and accurate representation of a company's equity ownership, enabling informed decision-making, efficient equity management, and the facilitation of important transactions. Let's go through each of them:

Visibility and Transparency: A cap table provides a comprehensive overview of a company's equity ownership structure, including the number and type of shares held by each investor, founder, or employee. This transparency is crucial for making informed decisions, negotiating terms, and understanding the company's financial landscape.

Efficient Equity Management: Maintaining an up-to-date cap table allows companies to easily track dilution, manage stock options, and plan for future funding rounds or liquidity events. This helps ensure equity is distributed and allocated effectively, which is essential for attracting and retaining talent.

Facilitation of Transactions: When a company is considering a merger, acquisition, or other major transaction, the cap table becomes a critical tool for evaluating the financial implications and structuring the deal. Having a well-organized cap table streamlines the due diligence process and helps ensure a smooth negotiation.