The Market Capitalization Formula

Market capitalization, often referred to as market cap, is a simple yet powerful indicator of a company's size and market value, providing investors and analysts with a snapshot of a company's financial standing.

The formula to calculate market capitalization is straightforward:

Market Capitalization = Current Share Price × Total Outstanding Shares

For example, if a company has 10 million shares outstanding, and each share is priced at $50, the market capitalization of the company would be $500 million.

This metric allows investors to compare the market value of companies regardless of their share prices or the number of shares they have issued.

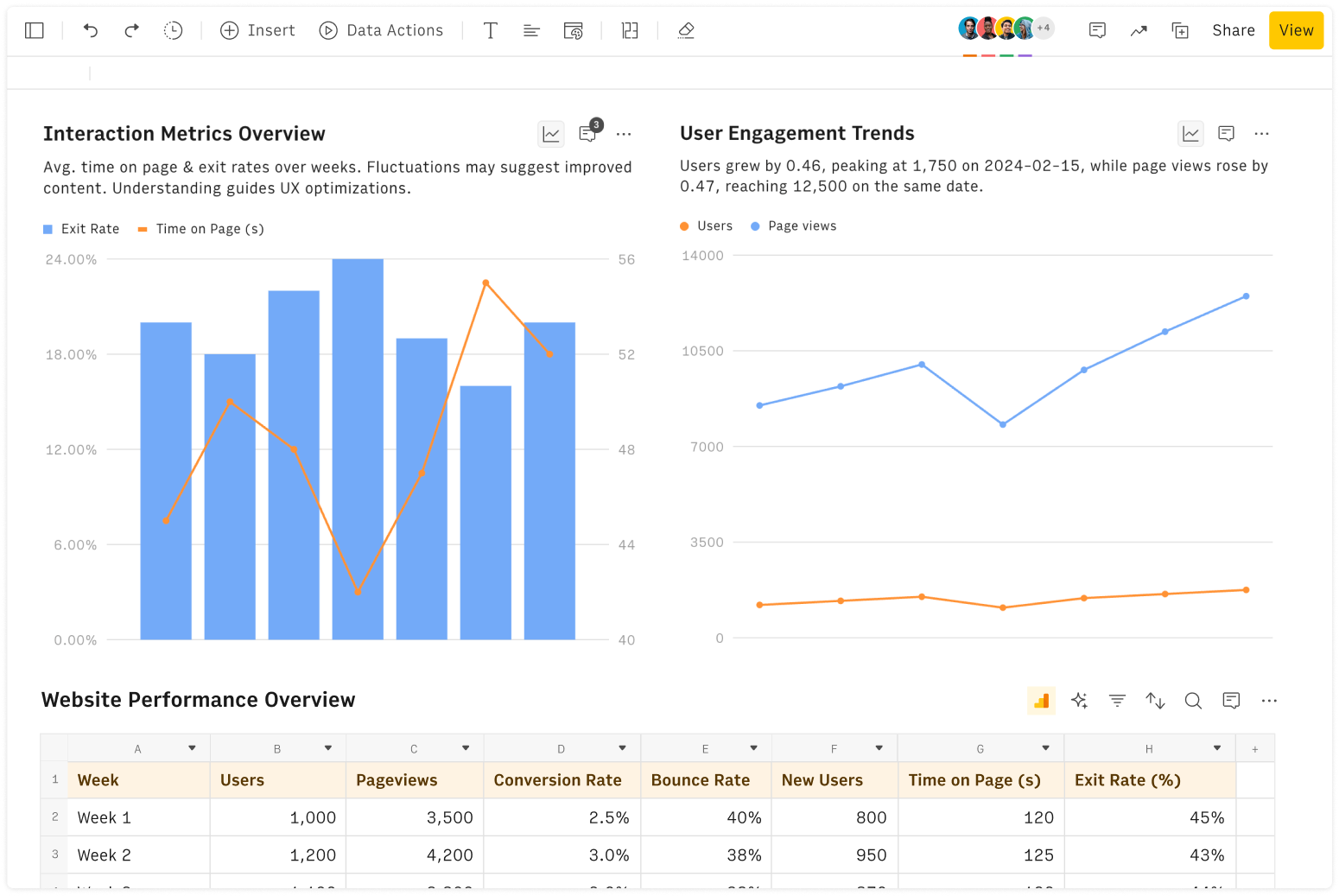

How to Compare Market Caps with Our Tool

Our Market Capitalization Comparison Tool is designed to help you quickly compare the market caps of two different companies.

How It Works:

Select the Companies: Start by entering the names of the two companies you wish to compare. The tool allows you to search from a wide range of publicly traded companies.

Automatic Data Retrieval: Once you’ve selected the companies, the tool automatically retrieves the current share price and the total number of outstanding shares for each company from AlphaVantage, a reliable source of financial data made available through API.

Calculate and Compare: The tool then calculates the market capitalization for both companies

The results are displayed side by side, providing a clear and concise comparison.

Market Capitalization Categories

Companies are often categorized based on their market capitalization into different classes, which helps investors identify the type of company they are dealing with:

Large-Cap (Big-Cap) Companies:

These companies have a market cap typically over $10 billion.

They are often industry leaders with a long history of stable earnings and dividends.

Examples include companies like Apple, Microsoft, and Amazon.

Mid-Cap Companies:

These have a market cap ranging from $2 billion to $10 billion.

They are often considered to have more growth potential than large-cap companies but with higher risk.

Examples include companies like Twitter or T-Mobile.

Small-Cap Companies:

Market cap ranges from $300 million to $2 billion.

These companies are generally younger, with more growth potential but also with greater risk and volatility.

Examples include smaller tech firms or regional businesses.

Micro-Cap Companies:

These have a market cap between $50 million and $300 million.

They are considered high-risk investments due to their smaller size and potentially lower liquidity.

Nano-Cap Companies:

These companies have a market cap below $50 million.

They are often very risky and may not be well-known, with stocks sometimes trading on over-the-counter (OTC) markets.

Largest Companies by Market Cap

Here you may find the list of the 50 largest companies by market cap:

🇺🇸 Apple (AAPL), $3.433 T

🇺🇸 NVIDIA (NVDA), $3.146 T

🇺🇸 Microsoft (MSFT), $3.079 T

🇺🇸 Alphabet (GOOGL), $2.041 T

🇺🇸 Amazon (AMZN), $1.851 T

🇸🇦 Saudi Aramco (2222.SR), $1.783 T

🇺🇸 Meta Platforms (META), $1.334 T

🇺🇸 Berkshire Hathaway (BRK.A), $973.51 B

🇹🇼 TSMC (TSM), $886.92 B

🇺🇸 Eli Lilly (LLY), $852.19 B

🇺🇸 Broadcom (AVGO), $770.38 B

🇺🇸 Tesla (TSLA), $698.63 B

🇺🇸 JPMorgan Chase (JPM), $619.24 B

🇩🇰 Novo Nordisk (NVO), $609.25 B

🇺🇸 Walmart (WMT), $604.19 B

🇺🇸 UnitedHealth (UNH), $537.97 B

🇺🇸 Visa (V), $518.44 B

🇺🇸 Exxon Mobil (XOM), $518.34 B

🇨🇳 Tencent (0700.HK), $451.96 B

🇺🇸 Mastercard (MA), $427.81 B

🇺🇸 Procter & Gamble (PG), $396.39 B

🇺🇸 Johnson & Johnson (JNJ), $391.32 B

🇺🇸 Costco (COST), $388.44 B

🇰🇷 Samsung (005930.KS), $385.14 B

🇺🇸 Oracle (ORCL), $380.99 B

🇫🇷 LVMH (MC.PA), $378.69 B

🇺🇸 Home Depot (HD), $370.38 B

🇳🇱 ASML (ASML), $370.11 B

🇺🇸 AbbVie (ABBV), $347.36 B

🇺🇸 Bank of America (BAC), $308.17 B

🇺🇸 Coca-Cola (KO), $297.74 B

🇨🇳 ICBC (1398.HK), $297.09 B

🇺🇸 Merck (MRK), $294.39 B

🇺🇸 Netflix (NFLX), $293.63 B

🇨🇭 Nestlé (NESN), $270.54 B

🇺🇸 Chevron (CVX), $268.64 B

🇬🇧 AstraZeneca (AZN), $268.10 B

🇨🇭 Roche (RHHBY), $267.96 B

🇩🇪 SAP (SAP), $257.33 B

🇫🇷 Hermès (RMS), $256.21 B

🇺🇸 Salesforce (CRM), $255.04 B

🇯🇵 Toyota (TM), $251.64 B

🇨🇳 Kweichow Moutai (600519), $249.07 B

🇦🇪 International Holding Company (IHC), $248.47 B

🇺🇸 AMD (AMD), $247.54 B

🇺🇸 Adobe (ADBE), $246.90 B

🇮🇳 Reliance Industries (RELIANCE.NS), $242.18 B

🇺🇸 Pepsico (PEP), $239.67 B

🇨🇭 Novartis (NVS), $239.10 B

🇫🇷 L'Oréal (OR.PA), $234.87 B

FAQ

Why Compare Market Caps?

Comparing market caps is a vital step in evaluating the relative size, stability, and market presence of companies. This allows you to make informed decisions by offering a direct comparison of the companies' market values.

How do I calculate market cap?

To calculate the market capitalization of a company, multiply the current share price by the total number of outstanding shares. This will give you the company's market value, which can be used to compare it with other companies in the same sector or across different industries.

How much market cap is good?

What constitutes a "good" market cap depends on your investment goals. Large-cap companies (those with a market cap over $10 billion) are generally considered stable and less risky, making them a safer investment.

Mid-cap companies ($2 billion to $10 billion) offer a balance between growth potential and stability. Small-cap companies (under $2 billion) can offer higher growth potential but come with greater risk.

How do you determine price by market cap?

To derive the stock price from market cap, you need to divide the market capitalization by the number of outstanding shares.