Top 3 reasons to use Rows in the insurance industry

Spreadsheet-based calculations play a critical role in both external and internal operations in the insurance sector. Externally, they are utilized for generating quotes, showcasing investment returns on customer-facing websites, and more. Internally, these calculations are essential for risk assessment, pricing models, and nearly every other aspect of the business process.

The challenge lies in the disconnect between business teams, such as actuaries who develop models within spreadsheets, and IT teams responsible for operationalizing these calculations. IT teams must either write code or create complex workflows to integrate these spreadsheets with other systems, ensuring the calculations are accessible and usable outside of the spreadsheet environment. This gap often creates inefficiencies and hinders seamless collaboration between departments.

Rows can enhance insurance workflows by integrating advanced spreadsheet capabilities with automation, AI, and seamless system integrations. It automates data management, ensuring real-time updates and accurate data flows between systems like CRMs and underwriting tools. Actuaries can build dynamic pricing models within Rows, while time-based triggers automate routine tasks such as financial reporting and policy renewals. Real-time collaboration and automated version tracking improve teamwork and compliance, while AI-driven insights help insurers predict trends and automate customer interactions. Rows also strengthens data security through automated backups and access controls, optimizing sales, marketing, and regulatory reporting. Overall, Rows boosts efficiency, accuracy, and responsiveness, positioning insurers to better navigate market changes and reduce operational costs.

Top 3 reasons to use Rows in the insurance industry

Unmatched Spreadsheet Capabilities

Our platform combines the familiarity of powerful spreadsheet functions like =VLOOKUP and =QUERY with advanced features such as API calls and time-based automations. This dual capability enhances productivity for business users and enables IT teams to tackle complex scenarios without the need to write, manage, or optimize code. By seamlessly importing and exporting data from external sources like databases and CRMs, Rows streamlines workflows and eliminates manual processes.

Enterprise-grade Computation API

Imagine making changes to your spreadsheet logic that can display the changes on your pricing calculator hosted on the website, without waiting for a code deployment.

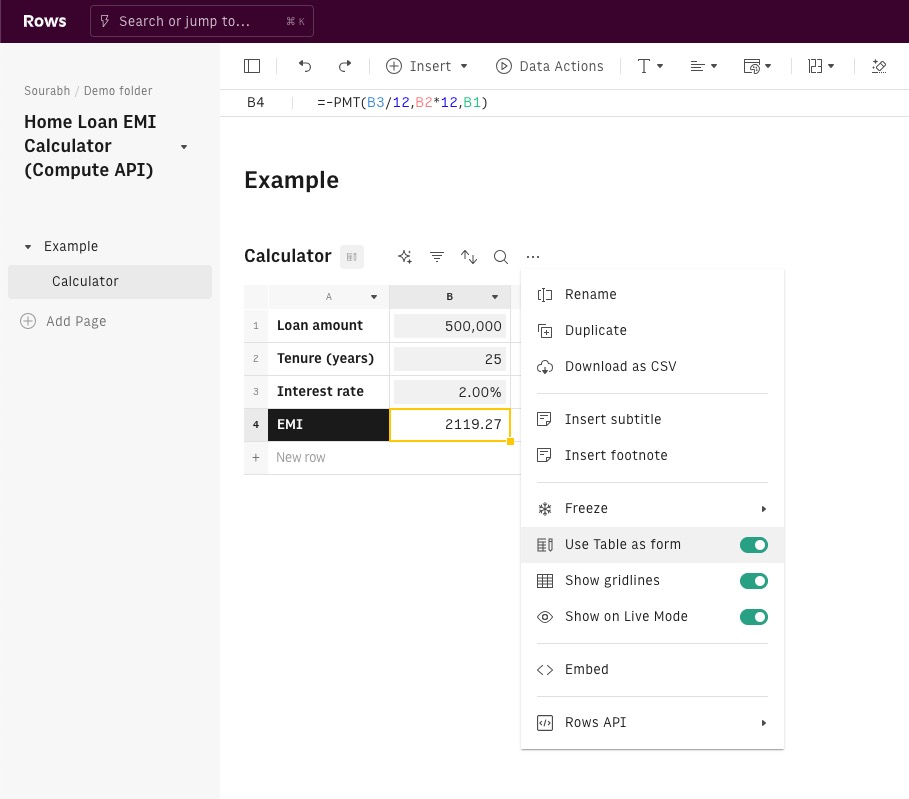

Our compute endpoint allows your spreadsheet models to be turned into APIs. In the insurance sector, this would help with bridging the gap between actuarial and IT teams. Actuaries can build and optimize their models in familiar spreadsheet environments, while IT teams can seamlessly integrate these models into applications or websites. This eliminates inefficiencies, ensures accuracy, and accelerates the deployment of complex pricing models, risk assessments, and other key calculations.

Future-proof with AI

With the help of our OpenAI integration and the ever-evolving AI Analyst, Rows can play a pivotal role in future-proofing the insurance sector by seamlessly integrating AI capabilities into spreadsheet-based workflows.

By enabling real-time data processing, advanced calculations and API integrations, Rows allows insurers to leverage AI for predictive analytics, risk assessment and personalized customer experiences. This positions insurers to stay ahead of emerging trends and enhance operational efficiency.

Wrapping It Up

While spreadsheets remain integral to the insurance industry, the challenges they present—such as data accuracy, scalability, and integration with other systems—underscore the need for more robust solutions. Rows offers a compelling alternative by combining familiar spreadsheet functionalities with advanced capabilities like API integrations, enterprise-grade computation, and AI-powered analytics. This not only bridges the gap between business and IT teams but also enhances operational efficiency, accuracy, and agility in a rapidly evolving industry. By adopting Rows, insurance companies can optimize their automation processes, future-proof their operations, and stay competitive in an increasingly data-driven landscape.

How do I start?

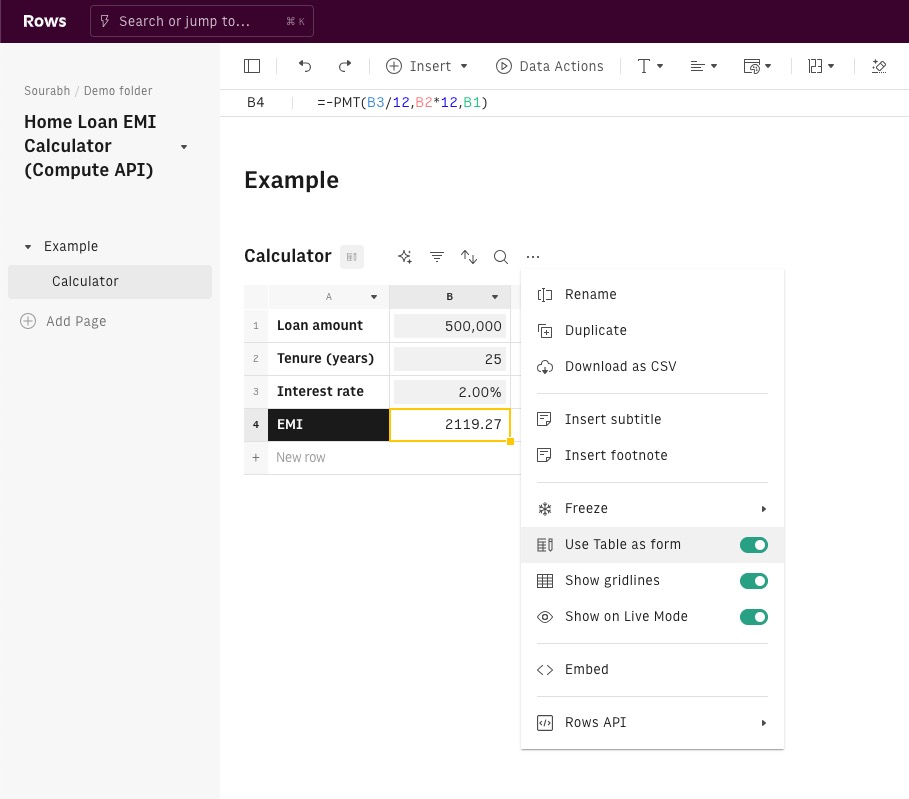

Create your Live spreadsheet: You can either import your model as an XLSX file, or you can build it from scratch. Use Action elements for the input values you want to modify with every API call. Make sure to enable the Use Table as form toggle (see screenshot below) for all relevant Tables in your spreadsheet.

Call the spreadsheet through Rows API: You can find the endpoint documentation in our API docs.

You can also read our documentation on using the spreadsheet as an API or access & share our quick 1-pager outline to understand this better.

As this is an Enterprise endpoint, please get in touch with us for test access by writing to enterprise@rows.com, or by using the Chat with us option in the support menu in your Rows account.