About Invoice Tracker Template

What is an Invoice Tracker Template?

Managing invoices effectively means staying on top of your payments and ensuring all your income is properly tracked. It's about having a clear system that automatically helps you match incoming payments with their corresponding invoices, eliminating the tedious task of manual bank statement reconciliation.

While it sounds straightforward, the reality is that:

Manual invoice tracking is time-consuming and prone to errors. You need to constantly check your bank statements - usually on a spreadsheet export - and match them against outstanding invoices - another spreadsheet list.

The first challenge often leads to delayed payment tracking, while the second can result in missed payments or confusion about which invoices have been settled.

Features of the Invoice Tracker Template

There are three main features that make this tracker stand out:

Bank integration: Our template connects directly with your bank account to pull live transaction data. This means you'll always have the most up-to-date information about incoming payments without manually checking your bank statements or importing CSV files.

Smart transaction matching: The 'Find transaction' feature allows you to quickly search through your bank statements using payment descriptions. This streamlines the process of matching incoming payments with their corresponding invoices.

Automated status updates: Once you mark an invoice as paid using the checkbox in the 'Paid' column, the template automatically updates the status. This gives you a real-time overview of your payment situation without any manual calculations.

Importance and Benefits of Invoice Tracking

There are several key benefits to using an automated invoice tracking system:

- It improves cash flow management

Keeping track of paid and unpaid invoices helps you maintain a healthy cash flow. Our template gives you a clear overview of outstanding payments, helping you follow up on late payments promptly and forecast your income more accurately.

- It saves time and reduces errors

The bank integration feature eliminates the need for manual bank statement checks. This not only saves time but also reduces the risk of human error in payment reconciliation.

- It provides better financial oversight

With all your invoice data in one place, you can easily generate reports on payment patterns, identify consistently late-paying clients, and make informed decisions about your billing practices.

How to Set Up the Invoice Tracker Template

Getting started with our Invoice Tracker template is simple:

Step 1: Connect your bank account Enable the bank integration feature to automatically pull your transaction data into the template.

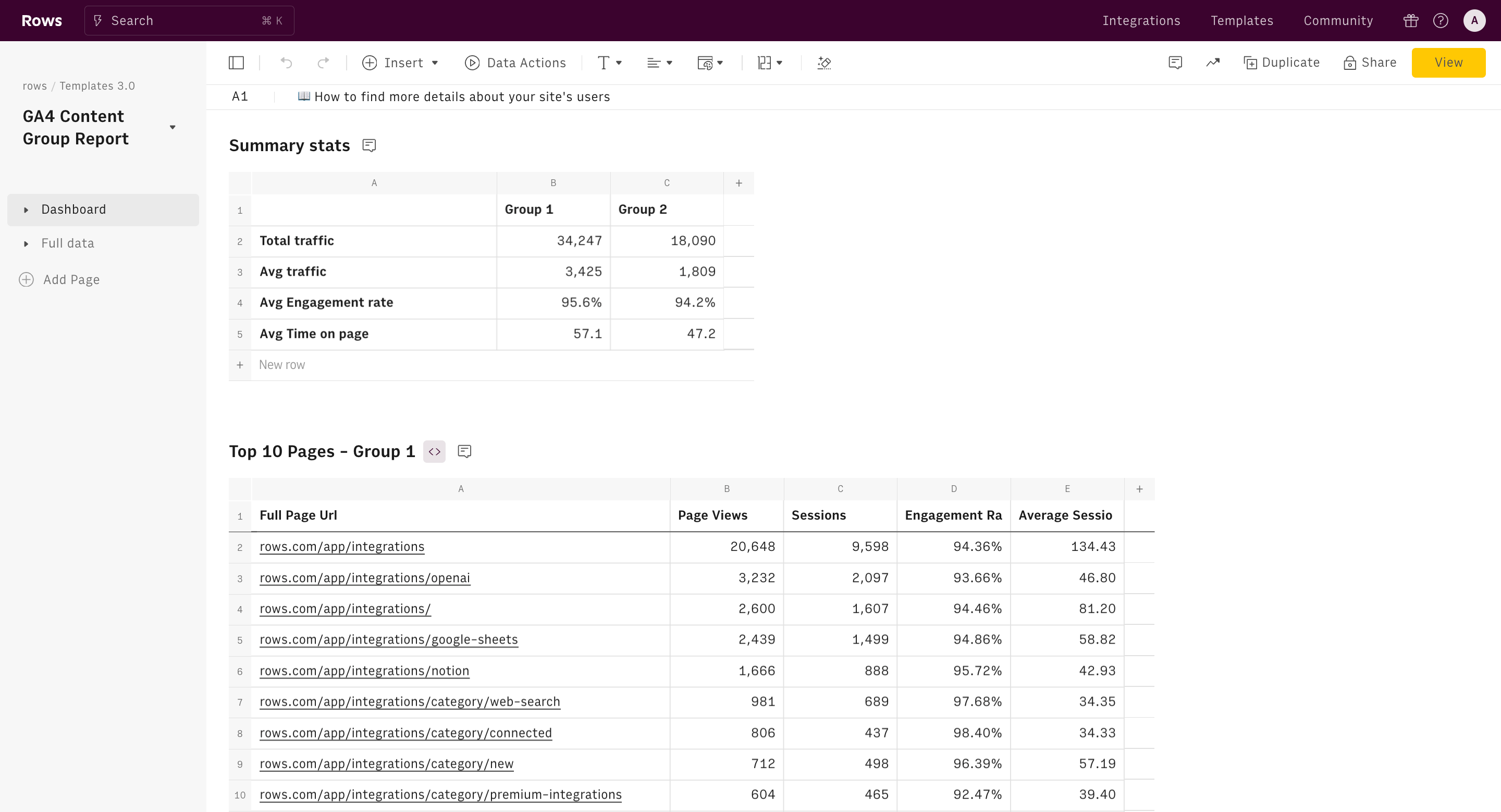

Step 2: Review your invoices Use the 'Invoice list' table to view all your outstanding invoices in one place.

Step 3: Match payments with invoices Check the 'Filtered transactions' table to see your bank activity and match payments with invoices. Use the 'Find transaction' search feature to locate specific payments quickly.

Step 4: Update payment status Mark invoices as paid using the checkbox in the 'Paid' column, and watch the status update automatically.

Key components at a glance

The Invoice Tracker template offers several essential features for efficient invoice management:

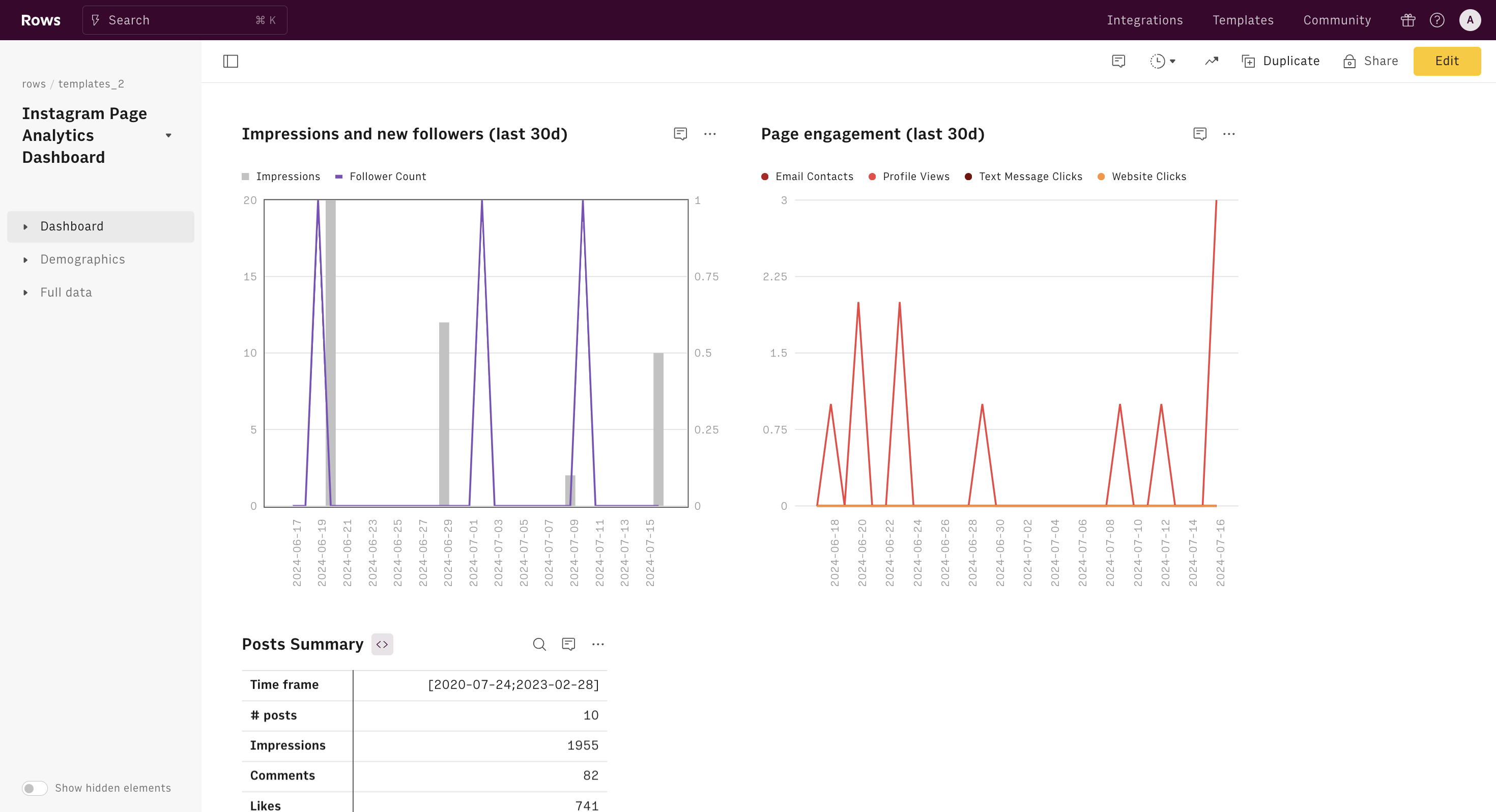

Invoice list table

- Displays all outstanding invoices in one view

- Shows payment status for each invoice

- Includes checkbox system for marking payments

Filtered transactions table

- Shows real-time bank account activity

- Allows date range filtering for focused review

- Integrates directly with your bank account

Find transaction feature

- Enables quick search through transaction descriptions

- Helps match payments with corresponding invoices

- Streamlines the reconciliation process

What should you monitor when tracking invoices?

When managing your invoices, pay attention to these key aspects:

Payment Patterns: Track how quickly clients typically pay and identify any consistent delays. This helps in planning follow-ups and adjusting payment terms when necessary.

Outstanding Amounts: Regularly review unpaid invoices to maintain healthy cash flow. Set up a routine for checking and following up on overdue payments.

Bank Reconciliation: Ensure all received payments are properly matched with their invoices. Regular reconciliation helps catch any missing or incorrect payments early.

How it works

How it works

Get started

Click on 'Use template' and start using it right away. No forms, no signup. Your data first.

Connect your Bank Account

Once landed on the spreadsheet, follow the instructions to connect your bank and pick your account.

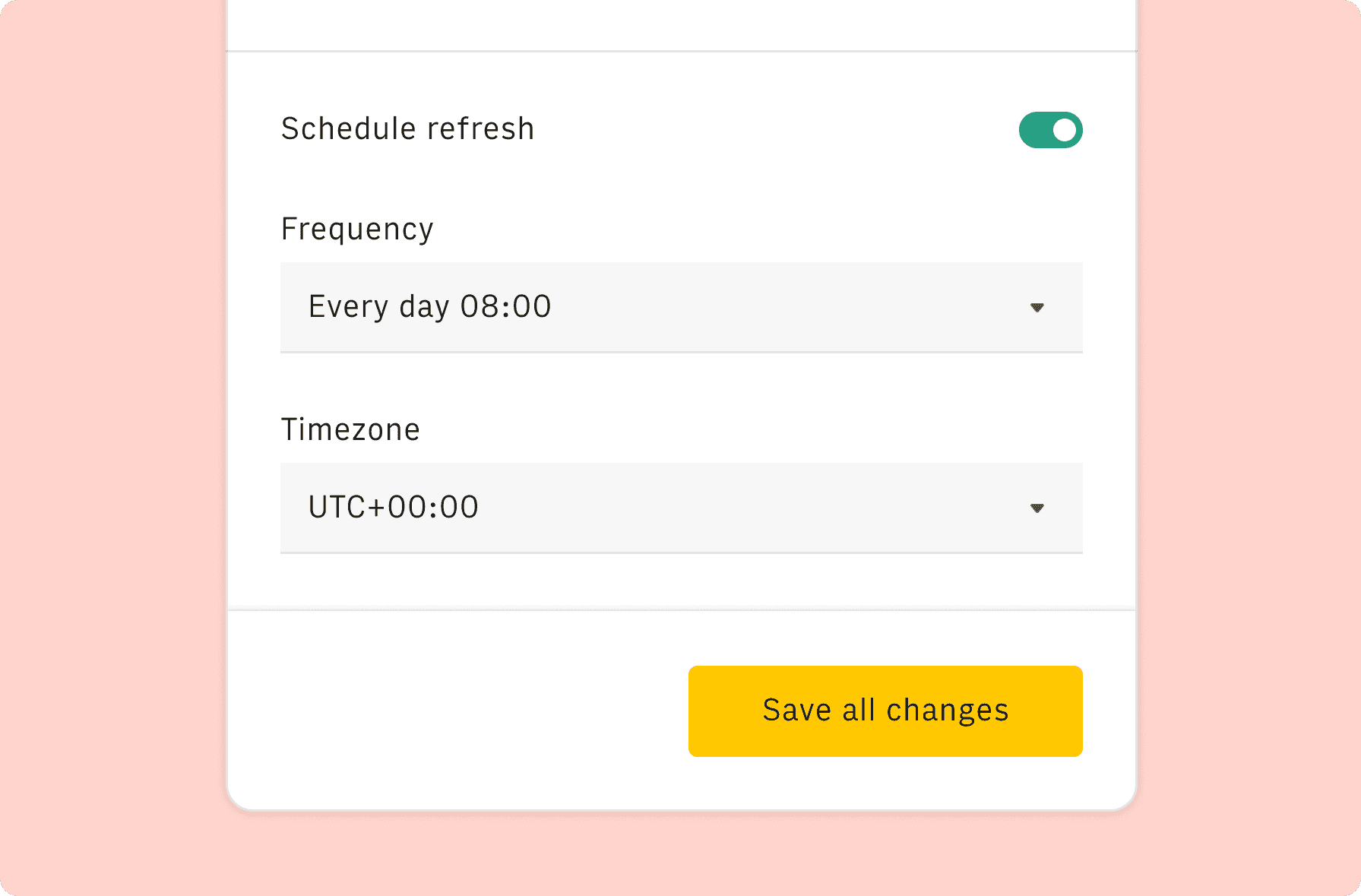

Customize the template and schedule refresh

Once the integration has been connected, all tables will update automatically with your own data. Click on 'Edit Source' to change the retrieved data and automate the data refresh. You can then insert a chart or a pivot table, add a column or personalize formats, using all the regular functions and shortcuts that make spreadsheets great.

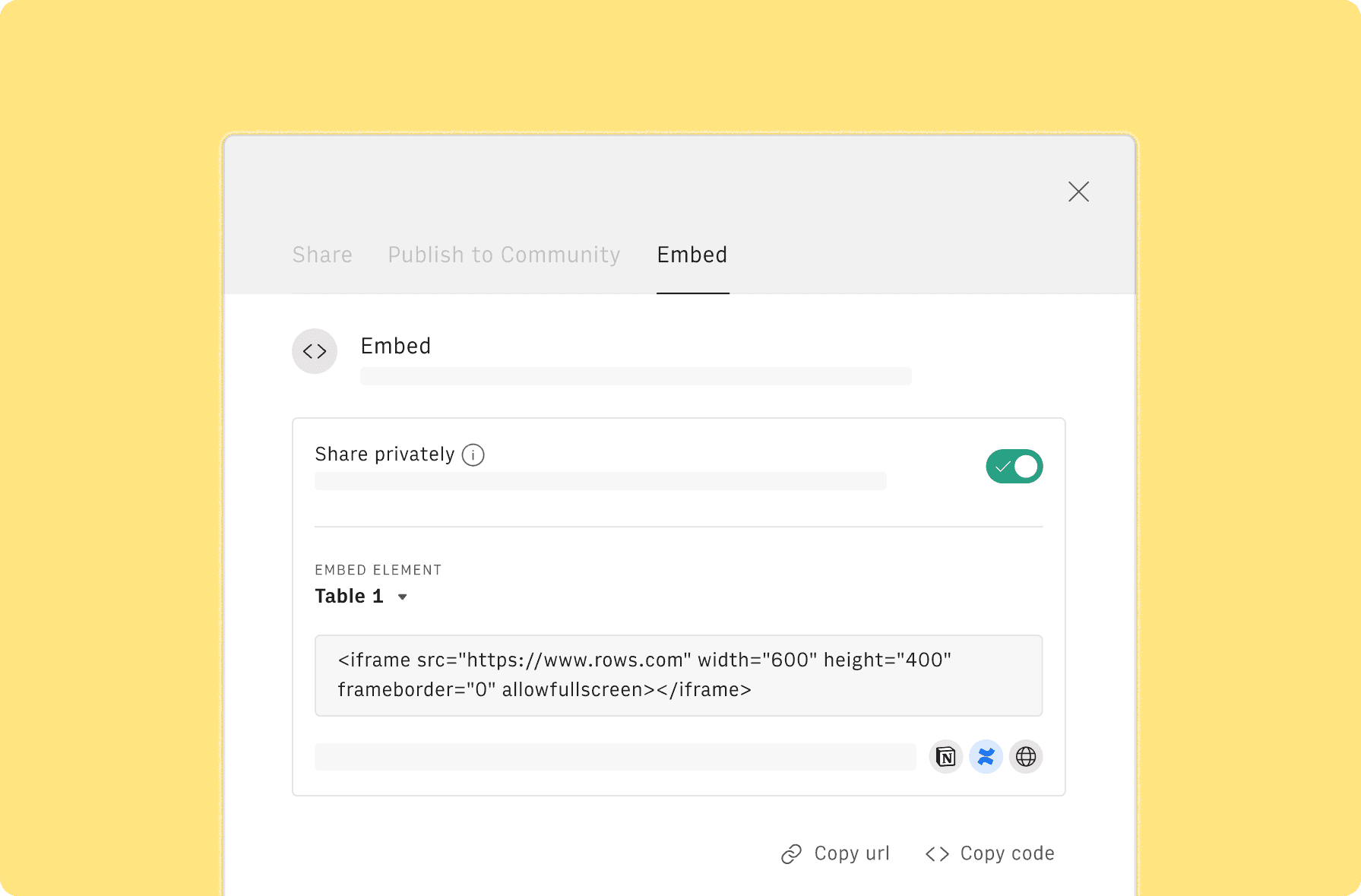

Embed tables and charts

Click on the option menu to embed tables and chart on your Notion, Confluence or any other iframe-ready documents.

Questions and answers

Can I use Rows for free?

More than an Invoice Tracker Template

Rows is your new AI Data Analyst. It lets you extract from PDFs, import your business data, and analyze it using plain language.

Signup for free

Import your business data

Extract from PDFs and images, import from files, marketing tools, databases, APIs, and other 3rd-party connectors.

Know moreAnalyze it with AI

Ask AI✨ any question about your dataset - from VLOOKUPs to forecasting models - and surface key insights, trends, and patterns.

Know moreCollaborate and Share

Seamlessly collaborate and share stunning reports with dynamic charts, embed options, and easy export features.

Know more