About Personal Expense Tracker

What Is Personal Expense Tracker?

Our Personal Expense Tracker is a straightforward spreadsheet designed to help you track your personal finances (income and expenses). It syncs automatically with your bank account, providing up-to-date insights into your spending, income, and overall financial picture.

Whether you're saving for a goal or simply want to understand where your money goes, this tool makes tracking your expenses easy and clear.

Key Components of the Personal Expense Tracker

This tool comes with several helpful features for managing your finances:

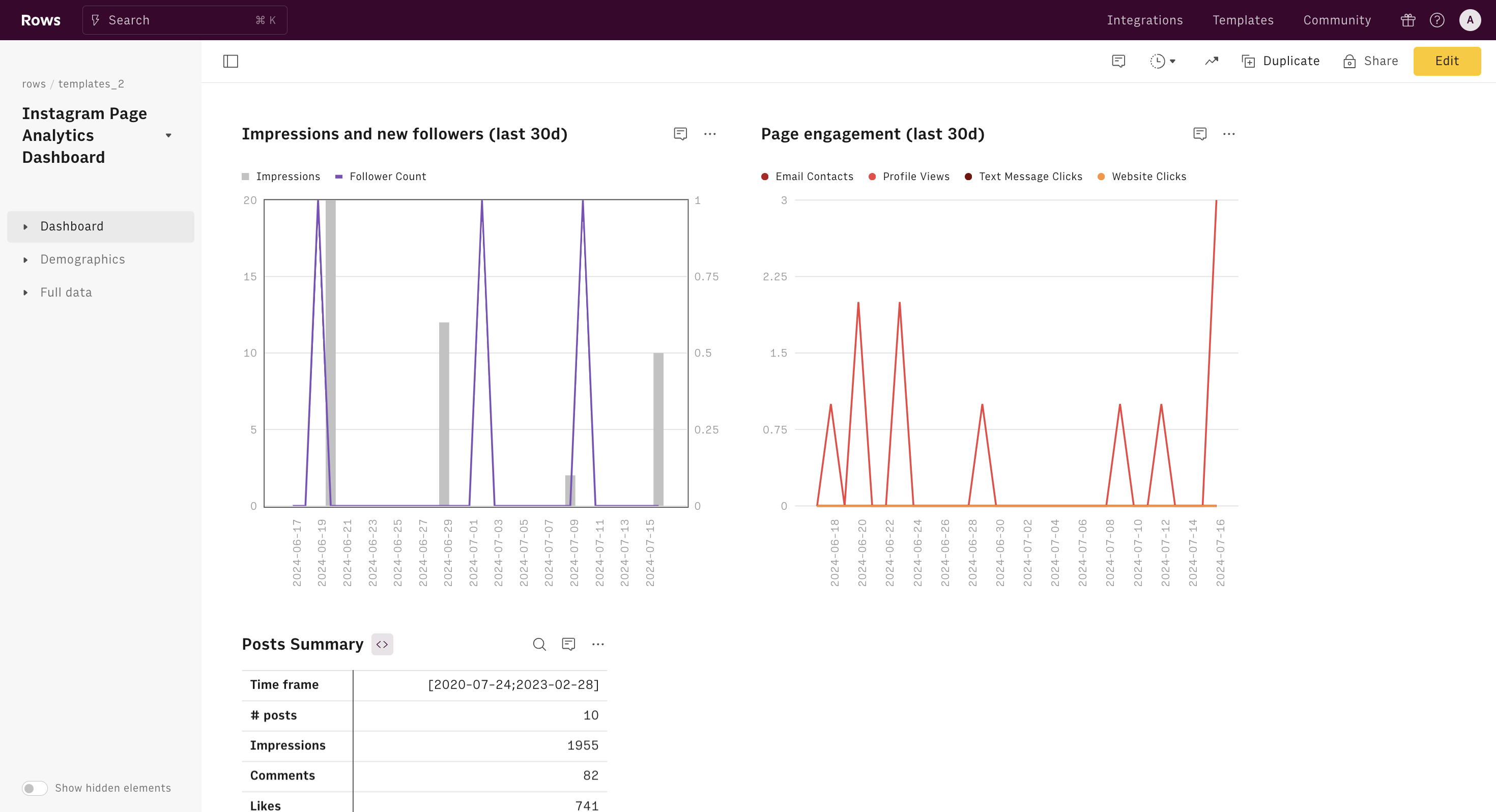

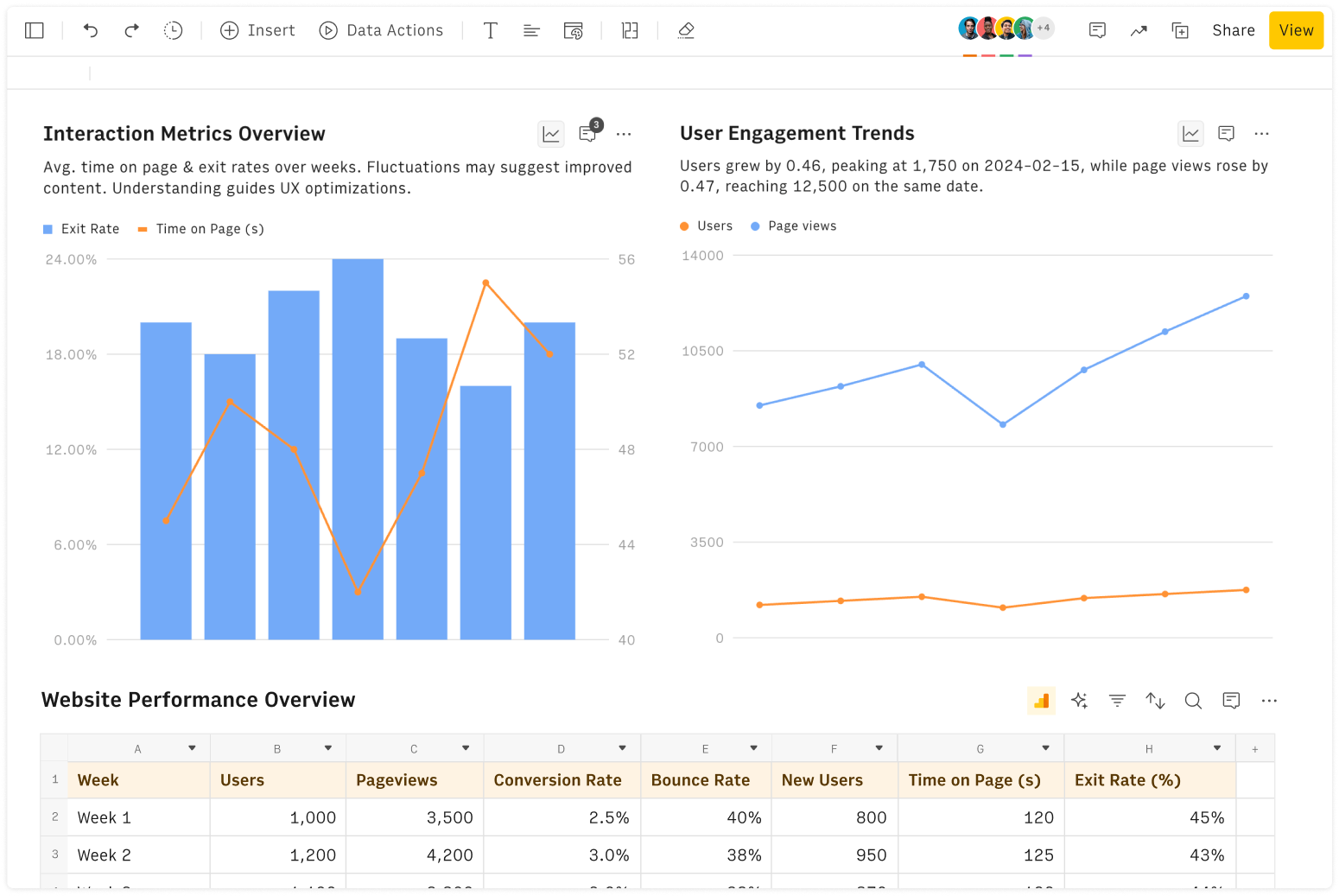

Dashboard

- Smart Summary: Instantly see your total income, expenses, and months with the highest costs.

- Monthly Balance Overview: View your net position with a clear monthly breakdown.

- Cash Flow Visualization: Analyze income and spending through easy-to-read charts.

Comprehensive Transaction Management

- Automated Transaction Sync: Directly syncs with your bank accounts to keep data updated.

- Category-Based Analysis: Categorizes your spending automatically to reveal patterns.

- Top Spending Categories: Highlights where most of your money goes.

- Advanced Search: Quickly find specific transactions with a robust search tool.

Customization Options

- Flexible Categories: Add or modify categories to fit your unique needs.

- Custom Date Ranges: Review finances over any time period.

- Personalized Tags: Create tags to organize transactions in a way that suits you.

How to Set Up the Personal Expense Tracker

Step 1: Get Started

Click the "Use Template" button and save the template to your preferred folder to create your own tracker.

Step 2: Connect Your Bank Account

Follow the secure process to connect your bank accounts, allowing real-time updates in the template while keeping your information safe with industry-standard encryption.

Step 3: Customize Your Experience

- Choose your date range for analysis.

- Open the "All Transactions" table.

- Review and categorize transactions.

- Go to the "Categories" page to add or adjust categories as needed.

Key Insights When Tracking Your Expenses

Tracking your expenses offers a clear view of your financial habits, helping you pinpoint opportunities to save and make informed decisions. Here’s what to look for:

What Is More Important to Look At?

Identifying patterns and trends is essential to making your spending work for you.

- Spending Patterns: Understanding recurring expenses can reveal where you might cut back or optimize spending. Spotting these patterns helps you identify opportunities to save or reprioritize spending areas.

- Category Distribution: By breaking down expenses into essentials versus discretionary spending, you can clearly see how much of your income goes to necessary items versus non-essentials. This can guide you in adjusting spending based on your financial goals.

- Monthly Trends: Some expenses fluctuate seasonally, and observing these trends can help you plan more effectively and set aside funds for higher-expense months.

- Income vs. Expenses Ratio: Tracking this ratio helps maintain a healthy balance between earnings and spending, reducing the risk of overspending and supporting better long-term financial health.

Benefits of Tracking Your Expenses

Financial Awareness

Gain insight into your spending, identify areas where you might save, and make better-informed decisions about managing money.Goal Achievement

Set realistic savings targets, monitor your progress, and adjust your spending as needed to stay on track toward financial goals.Better Budgeting

Create accurate budgets that reflect actual spending, anticipate future expenses, and build emergency funds with confidence.Long-term Financial Health

Build strong financial habits, increase savings, and plan effectively for major expenses or investments.

Start tracking your expenses today with Personal Expense Tracker to gain control over your financial future.

How it works

How it works

Get started

Click on 'Use template' and start using it right away. No forms, no signup. Your data first.

Connect your Bank account

Once landed on the spreadsheet, follow the instructions to connect your bank and pick your account.

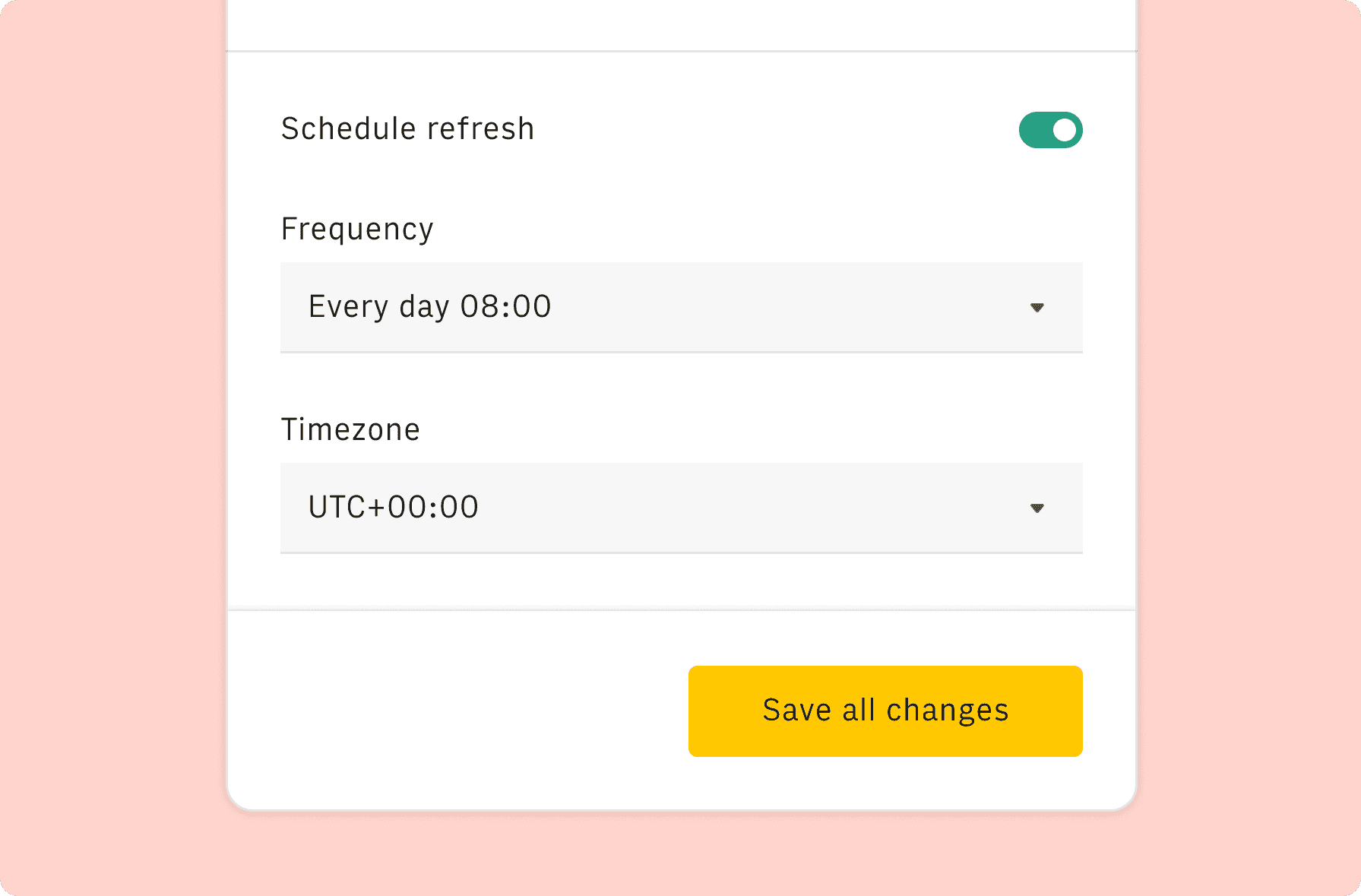

Customize the template and schedule refresh

Once the integration has been connected, all tables will update automatically with your own data. Click on 'Edit Source' to change the retrieved data and automate the data refresh. You can then insert a chart or a pivot table, add a column or personalize formats, using all the regular functions and shortcuts that make spreadsheets great.

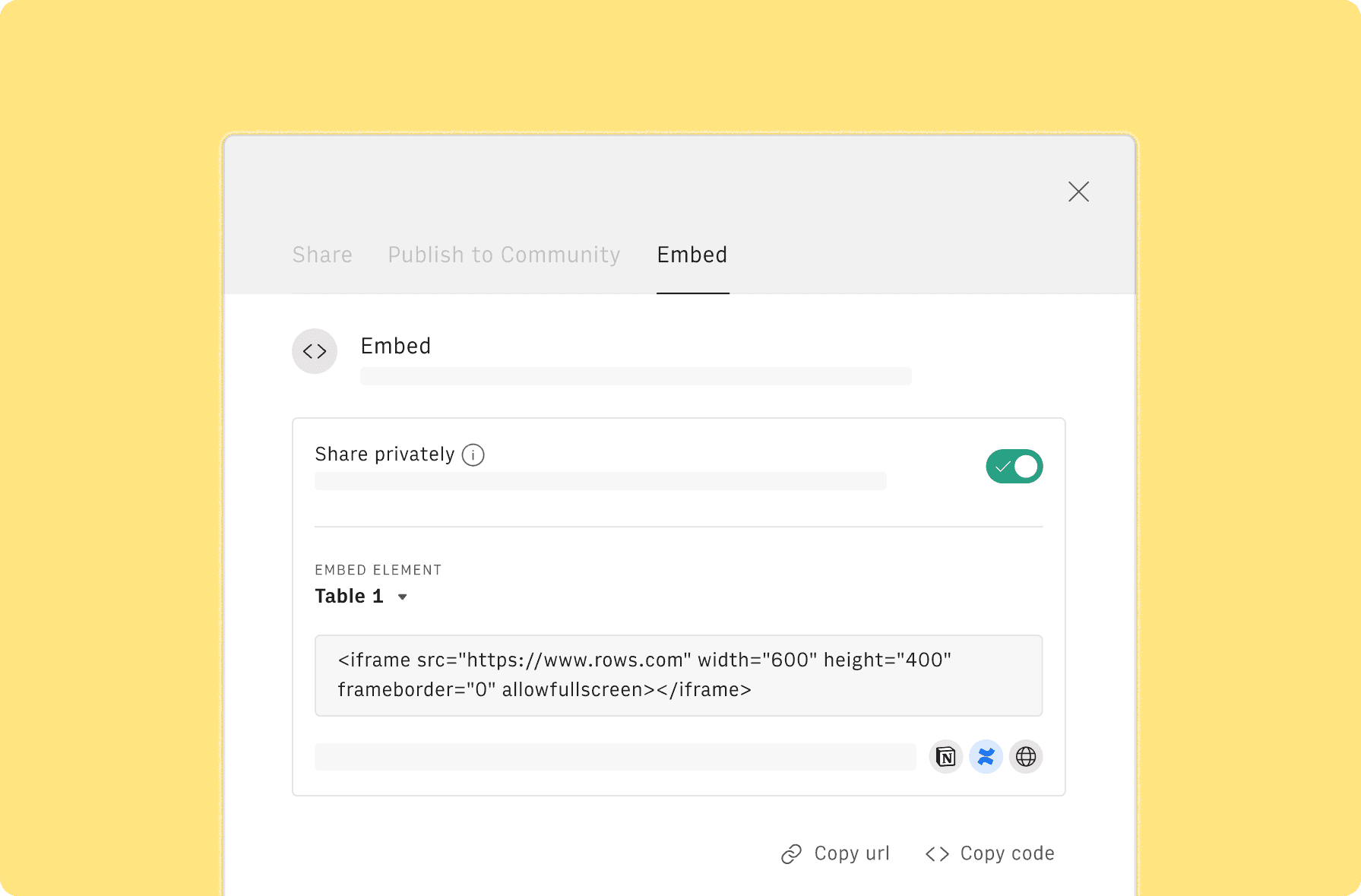

Embed tables and charts

Click on the option menu to embed tables and chart on your Notion, Confluence or any other iframe-ready documents.

Questions and answers

Can I use Rows for free?

More than a Personal Expense Tracker

Rows is your new AI Data Analyst. It lets you extract from PDFs, import your business data, and analyze it using plain language.

Signup for free

Import your business data

Extract from PDFs and images, import from files, marketing tools, databases, APIs, and other 3rd-party connectors.

Know moreAnalyze it with AI

Ask AI✨ any question about your dataset - from VLOOKUPs to forecasting models - and surface key insights, trends, and patterns.

Know moreCollaborate and Share

Seamlessly collaborate and share stunning reports with dynamic charts, embed options, and easy export features.

Know more